A meeting was held with the Kuetzal CEO this week. It didn't go well

Following our recent article about the Alborg Petrol case, and further concerns raised by the blog FinanciallyFree, a meeting was arranged this week in Riga by Jorgen Wolf with new Kuetzal CEO Maksims Reutovs. It was also attended by a representative of Explore P2P, and others. The goal of the meeting was to try and address the concerns that had come out of the due diligence findings of the P2P community. Unfortunately, in our view, none of those concerns were adequately addressed at the meeting. In fact several new concerns have been raised from this meeting.

These are our current biggest concerns, following this meeting:

1. Kuetzal admitted that it is having banking issues

Mr Reutovs confirmed that a bank account of Kuetzal had been “blocked” by their bank due to AML issues. Over the last week we are aware of many investors who have had significant delays in withdrawing funds from Kuetzal, but also that several have now received payments. It is not clear to us which bank account Kuetzal can be paying investors from, if their accounts are frozen. Mr Reutovs said that he planned to travel to Estonia to resolve the situation with his bank.

2. The previous Kuetzal team has left. The Riga office is closed

Several investors have expressed concerns that the previous CEO, Alberts Cevers has recently left the company to join another venture. We now know that essentially all of the other staff at Kuetzal left the business to join this new venture. The meeting had to be held in a cafe, as the Kuetzal Riga office has been closed down. Kuetzal say that they have plans to open a new office in Tallinn.

Mr Reutovs also disclosed that he has no employment contract with Kuetzal, and this was because he needed to apply for Estonian identification. Does Kuetzal have any contracted employees currently? It is not clear.

3. The CEO was unable to address any of the issues raised

At the meeting the CEO was asked whether he could provide evidence of bank wires between Kuetzal and Alborg Petrol, and this was declined. Further questions were asked about AA Development (a major loan), and Alpa Buve (a borrower in insolvency) and Mr Reutovs was unable to provide any information at all about the situations.

So who is Maksims Reutovs? He is a 24 year old former semi professional tennis player who lived in Barcelona until recently. He has held junior positions in various lending businesses. He is not an obvious candidate to act as a fiduciary on behalf of thousands of investors, managing millions of euros of their savings.

4. It isn't clear who really owns the business

The registered owner of Kuetzal is Viktoria Gortsak, a 29 year old female in Estonia. Explore P2P understands from various sources (although not confirmed yet) that this person exists, but is highly unlikely to have any actual involvement or economic interest with the company. The CEO was asked to provide evidence of any email communication between him and Viktoria Gortsak, which he was unable to do. The CEO instead said that he mainly communicated with Ms Gortsak’s “husband”, but he did not know the full name of this person (potentially the real owner of Kuetzal?)

5. One meeting was cancelled, and the other was almost cancelled

The day prior to the meeting, the Mr Reutovs attempted to cancel the meeting, citing the office closure. The meeting was only reinstated after the CEO was told that a cancellation would be viewed extremely negatively. As concerns were addressed about the ownership structure, Mr Reutovs offered a meeting the following day in Tallinn with Ms Gortsak, which was accepted. However shortly prior to the scheduled meeting in Tallinn this was cancelled without explanation.

Where does this leave Kuetzal's investors?

We don’t like to say it, but in our view – in a really bad position. It looks to us that right now there is no office, banking issues, a lack of employees, many questionable loans, a mysterious owner, and no answers. We have also seen Kuetzal introduce changes to their terms and conditions recently stating that they take no responsibility to perform any due diligence, or to operate the platform. That’s a huge red flag to us.

After our Alborg Petrol article, Kuetzal promised to appoint an independent auditor to review the situation of that loan. We hope they follow through on their promises, but don’t expect them to. We actually think an independent public audit is needed of the entire site and all its loans.

We are not saying that investors will not recover any funds. But we feel that it is necessary to at least provide the above information so that investors can form their own view, and take any actions necessary.

Unfortunately we believe there are currently a few other sites similar to Kuetzal operating right now. That’s why you won’t find several well known sites in our comparison tables, and never will. We will highlight some more sites where we see problems in coming weeks.

Update - 20 December

We’ve received a large amount of information from various sources since the post above. These are the key points we feel are sufficiently clear now:

At the meeting the CEO referred to receiving instructions from an ‘Andrei’, who was described as Viktoria’s (the owner’s) ‘husband’. We now believe this is a reference to Andrei Korobeiko, who is registered as living at an address in Tallinn that matches with the registered address of the Kuetzal company. Andrei and Viktoria are connected on social media although we don’t believe that they are actually married according to sources in the region.

The registered address of the company is in a soviet era residential apartment which is in a working class area and is thought to be worth approximately €50,000 only.

As pointed out today by Jorgen Wolf at Financially Free, and confirmed from other sources, Mr Korobeiko has a considerable criminal history, which includes money laundering. Several people have also been focusing on the sudden disappearance of former CEO Albert Cevers and his team, and the backgrounds of their family connections. Frankly, this is the point where it feels that our role analysing P2P investments has come to a natural end, and others who are more qualified and informed in these types of affairs will need to take over.

If you are interested in following an anonymous, but very well sourced and experienced financial analyst and investigator, we recommend following @Rpeerduck on twitter. They are based in the region and are regularly providing new information on the Kuetzal case, and other likely/potential P2P frauds.

Update - 8 January

Since our last update, most investors have been reporting that there has been no communication at all from Kuetzal, and they have not received the bank wires they requested. Today, an email conversation with the COO of TotalGames was circulated on Twitter that appeared to confirm that this company that Kuetzal raised €730,000 for in total recently had never received any funds or signed any contracts with Kuetzal. This is another very concerning development to us, but unfortunately not surprising now.

We understand that today some investors have received private communications from Kuetzal blaming bank account blocks due to AML as the reason for failing to send funds. Promises were made of funds being sent in February. Frankly, we don’t think that these are credible statements, although for the sake of Kuetzal investors, we hope that they are.

We would encourage all investors to download and retain copies of all transactions and documents from the Kuetzal website, in case the site goes offline and these are needed in the future. Some investors are beginning to make plans to pursue litigation if Kuetzal is not able to resolve its issues. In the case of litigation, or insolvency claims, it is very important to hold and save as much documentation as possible.

Update- 11 January - More concerns emerge

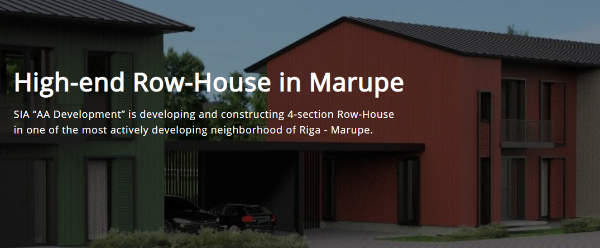

Over recent days a significant amount of work has been conducted by a group of Kuetzal investors, to investigate the legitimacy of loans listed on the site. We have been following their progress and will report on any significant new findings. One significant finding to emerge relates to one of the largest loans – ‘Row House in Marupe‘ with borrower AA Development. This is a loan of almost €600,000, and it was meant to be funding the construction of 4 houses in the Marupe area of Riga.

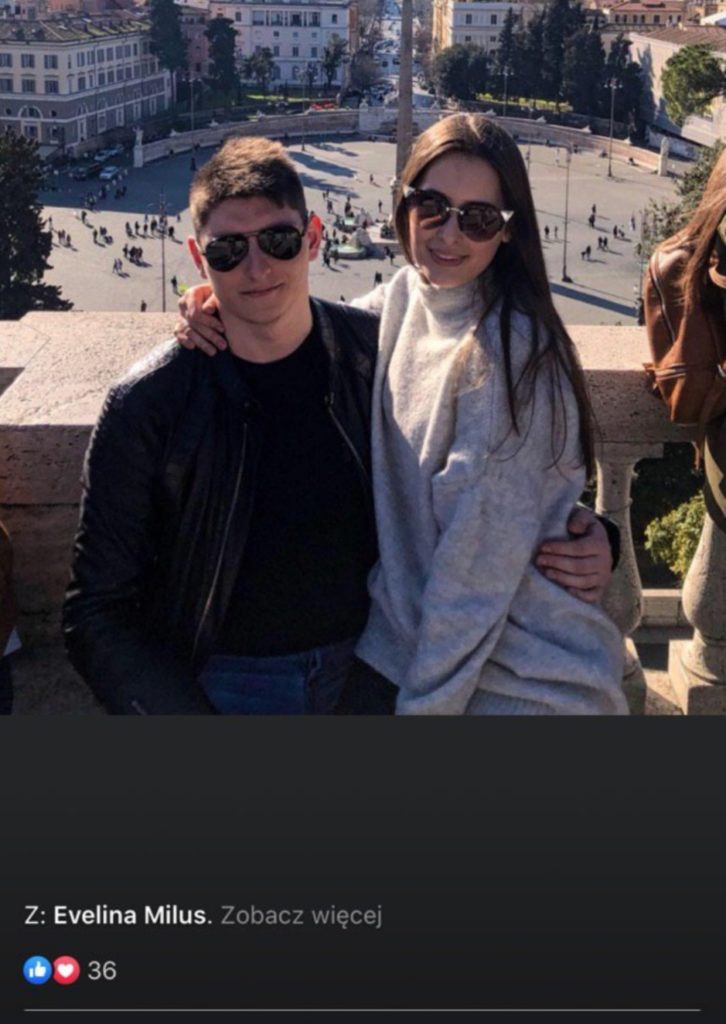

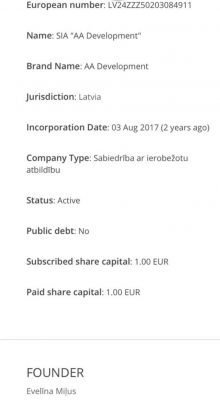

The registered owner of the company is Eugene Koshakov. Kuetzal described him as ‘CEO and Founder’. However records show that he became the registered owner only shortly before the loan went live on the Kuetzal platform. So who is the actual founder of this company? Public records show that it was Evelina Milus. Evelina Milus (now Evelina Cevers) is the wife of Alberts Cevers, the CEO of Kuetzal at the time the loan was originated. This was not disclosed and gives us significant concerns about what has taken place.

A Kuetzal investor has been able to provide a loan agreement that contains the cadastral reference number for the land that AA Development was meant to be building the row houses on. Public records show that this land is not even owned by AA Development, and that land has a registered mortgage secured over it in favour of a bank. Records also show that there are also no commercial pledges registered on the shares of AA Development in favour of Kuetzal (as would be expected at an absolute minimum).

A visit was made to this land site earlier today and (unsurprisingly) no construction work has been started at this location.

So in summary it seems that Kuetzal investors are left with no collateral at all, and a loan to a company that has close links to the former CEO of the business.

Update January 12 - Kuetzal shuts down

Today Kuetzal sent an email to all its investors announcing a wind-down of operations, due to the harm its reputation it had suffered over the last month. It also announced that both of the banks it had been using – SEB and Papaya (Malta) had frozen their bank accounts due to anti money laundering provisions. The accounts will be frozen indefinitely.

What do we think about this? We are not surprised in any way. We realise that to some extent this will reduce the potential ‘hope’ that some investors may have had about the situation. Many investors will be affected, and some have invested very large sums. This is a very difficult, painful result for them. However in some respects we are very happy to see that a seemingly dishonest P2P investment site, run by a questionable management team, has been forced to close down very quickly once concerns were raised. Yes, current investors are likely to see some losses take place. They may be quite high. But the total amount of those losses will be significantly less than if Kuetzal had continued to operate. We expect more news to emerge relatively quickly about where the funds invested into Kuetzal is likely to have gone.

Kuetzal investors have created a Telegram group (download this app to your phone) called KuetzalDiscussion. We would encourage all Kuetzal investors to join this group to discuss their future actions, options and monitor progress in this case. Kuetzal investors have already started to arrange litigation actions and co-ordinate with police and government bodies. We wish them the best and will be publish any significant events that follow in coming weeks.

Pingback: Kuetzal è veramente uno SCAM? - P2P Investing

Pingback: Sterling – December 2019 - European P2P lending portfolio update - P2P Millionaire

Argh, This is very disappointing news as that was the project I had most of my money in!

Possible lessons to be learnt.

I guess there is nothing to do but to wait and see what happens over the coming weeks.

Matt / thewahman

Can you still log in on Kuetzal webpage? For me it’s not working.

Hi Marko they closed down today. Investors can get access to some parts of the site when logging in.

Blogger Vitor will fly to Riga 16./17. and meet Kuetzal https://dversifi.com/flying-to-riga/

Pingback: FAQ's - here's what investors have been asking us recently

I made two smaller payout requests on Dec 20th and 5th January and did not receive them. Also no answer to my emails. Are you guys ore successful?

Hi,

Please note that we are coordinating a collective law action if things go sideways this month. If you want to join, please reach through the following Telegram group:

CrowdlendingGlobal.

Thanks

I invested a pretty high amount with Kuetzal, and, being a psychotherapist (and physician), i’m looking for reasons not to panic. Panic and excessive withdrawals from our side might create more dangers than their seemingly semi-professional work did in the past.

• What reassures me the most: Kuetzal installed Maksims Reutovs as their new CEO – he has almost 3 years of experience in lending companies: twinero.es and T-Presta. And he is a graduate having studied 3 years at https://www.euruni.edu/en/Campuses/Barcelona/EU-Business-School-Barcelona.html (both according to linkedin).

• If Kuetzal would betray, would it make sense for them to hire an expert who could be a very competent witness against them in case of judicial proceedings? Not really. And, it would not make sense for Mr. Reutovs to spoil his financial career and reputation by working for them.

• Imagine the worst, they take most of our money, trying to escape and hide. Maybe many, but at least some angry and determined investors would try to find them.. not a very nice perspective if you want to enjoy being rich. Remember that Kuetzals Investors are not all scoolgirls but pretty adventurous too, by definition. It’s much more comfortable for them to become rich by improving their work with a better CEO – which they did when problems with the Alborg project begun. It’s not so absurd to blame the former CEO for the mess and hope for better times coming, now that they are under everyone’s observation.

• It could be seen as a good sign also that when Jørgen from financiallyfree.eu visited Kuetzal and 4 of their projects in may 2019, he reported only positive news and impressions – even if he changed his mind now.

Hi Cedric. Regarding the projects that were visited – I understand that since then one of the registered borrowers has gone insolvent, and it’s not actually clear any longer who owns those assets. It also doesn’t seem that any mortgages were taken against the properties which is very surprising. Regarding withdrawals – as a business Kuetzal should always have held in escrow the un-invested funds held in trust for its investors. If that is the case, withdrawal requests would not be an issue at all. The ‘Kuetzal care’ buybacks are more problematic but they could have defaulted on those obligations and everyone would then at least understand and possibly accept that this was always a bit of an unreliable and unfunded promise. There are many rumours about the current situation and what has really happened which I won’t repeat. One point where I disagree with you though – neither Maksims or Alberts really had the experience or background to really be a CEO of this type of business. Both of them had very junior roles at the companies you mentioned. If there are any funds are missing, its not likely that it is the public faces, registered people associated with the company that investors will need to be pursuing. The situation is likely to be much more complex. It’s too early to know whether it will head down that path. But investors will really want to start seeing their cash, and full communications within the next few days or concerns will really start to mount.

Another Kuetzal project that doesn’t add up is Beta Health.

https://kuetzal.com/en/beta_glucan/

In this interview with Crowdleningrocks, Alberts Cevers said that the loan was taken out to improve the website, launch products on Amazon etc. and that the company had “loyal customers” that order their products online:

https://youtu.be/WbBa4_XRb0A?t=2753 – at around 45:55 minutes.

Well, here is the website: http://betahealth.eu/

Only the “About” section and parts of the shop work (with no images): http://betahealth.eu/about/

A smaller loan of 38.900€, but still….

Hi Angelo. You are right… No money has been spent on that website…. We found some of their products on ebay.com, but there has only been a review from one purchaser in the last 6 months, so it does not really seem to be selling. Not clear how this money will be repaid even if it is a legitimate loan….

Hi.

I consider myself as a big Kuetzal looser. Lesson learned. Maybe, maybe things are not so terrible, as I had been receiving my interests for all the projects on time so far. So there is a small light of hope somewhere.

Looking back on what it happened I guess I just read many blogs in which says that Kuetzal is great and bla bla bla. Obviously I didn’t do my homework looking in detail who was behind each platform and it is time to pay the consequences…

It seems that there is a big amount of bloggers that are just willing to write something about a website to get visits to their blogs and also to get money from referral bonuses. Still today you can find blogs saying how good Kuetzal is. So sad.

On reading more blogs there are certain that warn you about certain platforms but they actually don’t want to tell you why. There are blogs which tell you that there are other websites that might be a scam but they don’t clearly state names or reasons. For example “Unfortunately we believe there are currently a few other sites similar to Kuetzal operating right now” 😛 Why not giving names and reasons? I think as a community all this information should be shared as soon as it is known and send warning voices asap.

It will be nice for example if we can make a forum and discuss each platform all together instead of having dozens of bloggers telling us how good has been their experiences with each platform.

So in short I am wondering Monethera, TFGcrowd, Wisefund, Crowdestor, Grupeer and even Mintos, are they trust worth? Yes, no, why?

For example at this moment I have no good reason for trusting Mintos, and the only argument that I find everywhere is that it is very big, has worked for some years, and it is growing. Still I have many questions about some LOs in there. Well, there are also other sites that are also growing fast and have also some dark issues about LO’s. Anyways… Let’s see how all this ends up.

Thanks for your post, you are doing a great job

Pingback: Profitable investment - Portfolio update December 2019

Pingback: My p2p loan portfolio in 2019 | FinanciallyIndependent.eu

Just curious, for those who had received any transfers from Kuetzal – what bank they were sent from EExx or MTxx ? What about any transfers received in january? Anyone?

I got a transfer from them on the 10th of December (so just before sh*t hit the fan) and it was already from MT bank.

Pingback: Actualizare portofoliu Decembrie 2019 - Independent financiar

Pingback: Actualización de cartera Diciembre 2019 - Inversor Millennial

Pingback: Introducing P2P Lending Monitor - alerts and warnings of major events

Dear Oscar, here are a few thoughts on your Kuetzal concerns:

1. AML Issues/Kuetzal’s Bank Account: My bank account in Germany was cancelled last year because the bank supposed money laundering issues. That was just because of normal P2P investments. This proves that banks can be excessively suspicious and overreacting when it comes to AML issues.

2. The previous kuetzal team has left: If the Alborg Petrol project was not managed properly, i am happy that they left. Since they seemingly all went away at the same time, it may well be that their jobs were terminated because of their mistakes in the Alborg Petrol project.

Concerning the office: giving up an office can be a clever decision economically, and rebuilding a team can be a good moment for that change.

Mr. Reutovs announced a new office in Tallinn, and the address is already available on kuetzal.com right now.

Kuetzal has 29 projects now. It can be considered normal that Mr. Reutovs cannot give detailed answer about all of these projects spontaneously, especially as he needs to resolve the issues mentioned above at present. He also was new at the company since 14 days when you met him (according to Jørgen Wolf on financiallyfree.eu).

And, why please do you call Maxims Reutovs a “former tennis player” although he has successfully accomplished 3 year of studies at the EU business school to achieve a BBA graduation (Bachelor of Business Administration)? Mentioning this would have been more important than his age.

It also might not matter too much if at Kuetzal he is paid through an employment contract or on another basis.

Not showing you any Kuetzal bank wires or emails from the official Kuetzal owner, Viktoria Gordsak, can also be interpreted as security related, sitting in a café with unsecured Wi-Fi connection.

If the partner of Mrs. Gortsak, Andrey Korobeiko, is more active at Kuetzal than her, it might simply be for tax reasons that she officially is the owner of Kuetzal. If Mr. Reutovs signed his agreements with Mrs. Gortsak, he might well have found it sufficient to keep in mind the first name of her partner. It’s not that strange since even we p2p investors are all addressed by our first names by all platforms.

But the fact that Mr Reutovs knows the first name of Mrs Gortsak’s partner shows that he is in contact with her. No emails are needed as a proof for that.

Last not least: The “real owner” of Kuetzal, Andrey Korobeiko, was sentenced 2012 for money laundering that happened in 2010. The rest of what you call a “a considerable criminal history”, resumes to “a minor criminal case (..) probably a bar fight or something”, according to Jørgen from financiallyfree.eu. He writes: “I’m not worried about that one, this happens all the time.”

I think: People can become better persons for many reasons, one of them being penalized, as he was in 2012.

Hi Cedric. You might be right, this could indeed just be a series of several unfortunate coincidences and everything is fine. An alternative, less relaxed view we have heard is that thousands of people have now potentially provided their banking details and identity documents to a convicted money launderer.. We genuinely hope you are right, and no money has been lost, and the documents are safe. But we don’t see any downside in at least raising these obvious concerns publicly, and have received dozens of messages so far thanking us for doing so.

I see your point Oscar. But having done something ten years ago does not mean being a “convinced” whatsoever. Otherwise i would be a convinced (….. many things). But I’m not.

Hi,

Thanks for the post. My name is Guillermo, I initiated a withdrawal for EUR 6k on Dec 19th and waiting for Kuetzal to process it.

Sharing with you what I mentioned to Jorgen in his post, if no money is received the first week of January we should coordinate for a class action with an Estonian law firm. It will be much more effective.

Merry Christmas all

Hi Everyone!

Thanks for this news. I search for this new Kuetzal address (Mustamäe tee 149a-24) and I found something. A Company named TOKYO GROUP OÜ was existed , https://www.teatmik.ee/en/personlegal/12555648-Tokyo-Group-O%C3%9C, but with a status DELETED. Two private person in this Company Andrey Korobeyko and Vita Oša-Hasana. One click on the name Andrey Korobeyko and you found 4 Company connected. https://www.teatmik.ee/en/personprivate/58266-Andrey-Korobeyko.

Pingback: Sterling – October & November 2019 - European P2P lending portfolio update - P2P Millionaire

Hi Oscar,

Thank you so much for all this investigation, this is priceless. Your blog is definitely one of the most useful for p2p investing.

Nonetheless, I’m a little ambiguous toward your “teasing about some well known platform with potentially same risks than Kuetzal and not in your list of platform”, because it can lead people into guessing and guessing wrong: I can totally imagine Monethera or wisefund in your “risky List” but others could imagine Crowdestate , while Crowdestate track record, project quality, management team and structure is light years away from the formers.

I don’t really understand why you can’t just say “personally I don’t feel comfortable investing in platform x,y,z” – it cannot expose you to any pursuit, and would definitely help your readers who trust your judgement (and are still free to ignore your feeling and still invest in those platforms).

Thanks again so much for all your great work (with Kuetzal, and also your originators ratings and so many other useful articles)

Also

Hi Alex thats a fair challenge. As we said in the post, we plan to do more articles in coming weeks. But there are far too many that dont make the grade right now. Some sites will promote anything if they receive a big commission affiliate offer. We have always tried to take more of a curated approach that excludes certain sites. It is the same reason you dont see anything crypto related for example. For now i would encourage you to read two of our past posts. One is called ‘are you the dumb money?’ and the other is ‘fake and scam sites – what to look for’.

Also received funds without a problem. They answer emails and seems to be working fine. Don’t know about Tallinn office, but in Riga they had other office than on the picture.

Hi Luego that is great to hear. Just to be clear the office photo is just for illustration. The lady pictured is also not the actual owner…

It seems that my message from 12.12 regarding the owner of the apartment that is specified as Kuetzal address (Mustamäe tee 149a-24) went unnoticed. The apartment belongs to a guy with possibly a criminal record (according to media). Of course, it doesn’t necessarily mean that he is somehow related to Kuetzal, but who knows… Checking his name is a simple task that anyone can do:

https://kinnistusraamat.rik.ee/detailparing/Avaleht.aspx

Watch this space….

I received 3100 € back with no problems on 10th of december.

Alyona Krancmane answered emails immediately.

So there seems to be someone apart fom the CEO.

Pingback: Eine schöne P2P Bescherung – ⚠ Betrug/SCAM bei Kuetzal und Envestio? | P2P Game - ein Investment Tagebuch

Thanks for the update, will update my blog as well! I sent my buyback request on 12th of December and still didn’t receive the money.

It is clear to me that they took the money and run away, leaving a naive young boy without even an employee contract to manage the ruins that they left behind. I have only 300 euros in Kuetzal but this article alarm me about other p2b platforms that I invested in, with serious money. Thanks a lot for opening our eyes.

thank you for the update! I am glad I trusted my gut and didn’t invest in Kuetzal. I hope no investor ends up losing money.

I would be interested to hear your opinion about Crowdestor, since they are one of the platforms you haven’t included in your comparison table.

Very interesting post, thanks.