Last updated: 23 March 2020

How to find the best Mintos loans

Mintos currently offers loans from 70 lenders. That’s a lot of choice, which is great, but it can also make it hard to create a portfolio that has the optimal balance of risk and return. The quality of the different lender on Mintos varies dramatically, which also makes loan selection even tougher. For over a year, we have been publishing our Mintos Lender Ratings, to help investors identify which lenders have the strongest credentials, and which are higher risk. This has been a very popular feature, and so today we are launching our new Mintos Loan Scanner. Our Loan Scanner builds on our lender ratings and adds information about current interest rates, and the supply of loans on the primary market, to help investors quickly see what is available across the primary market, and what the best opportunities may be. We plan to regularly update this page as interest rates, lender ratings and loan availability changes.

What are the best Mintos loans available?

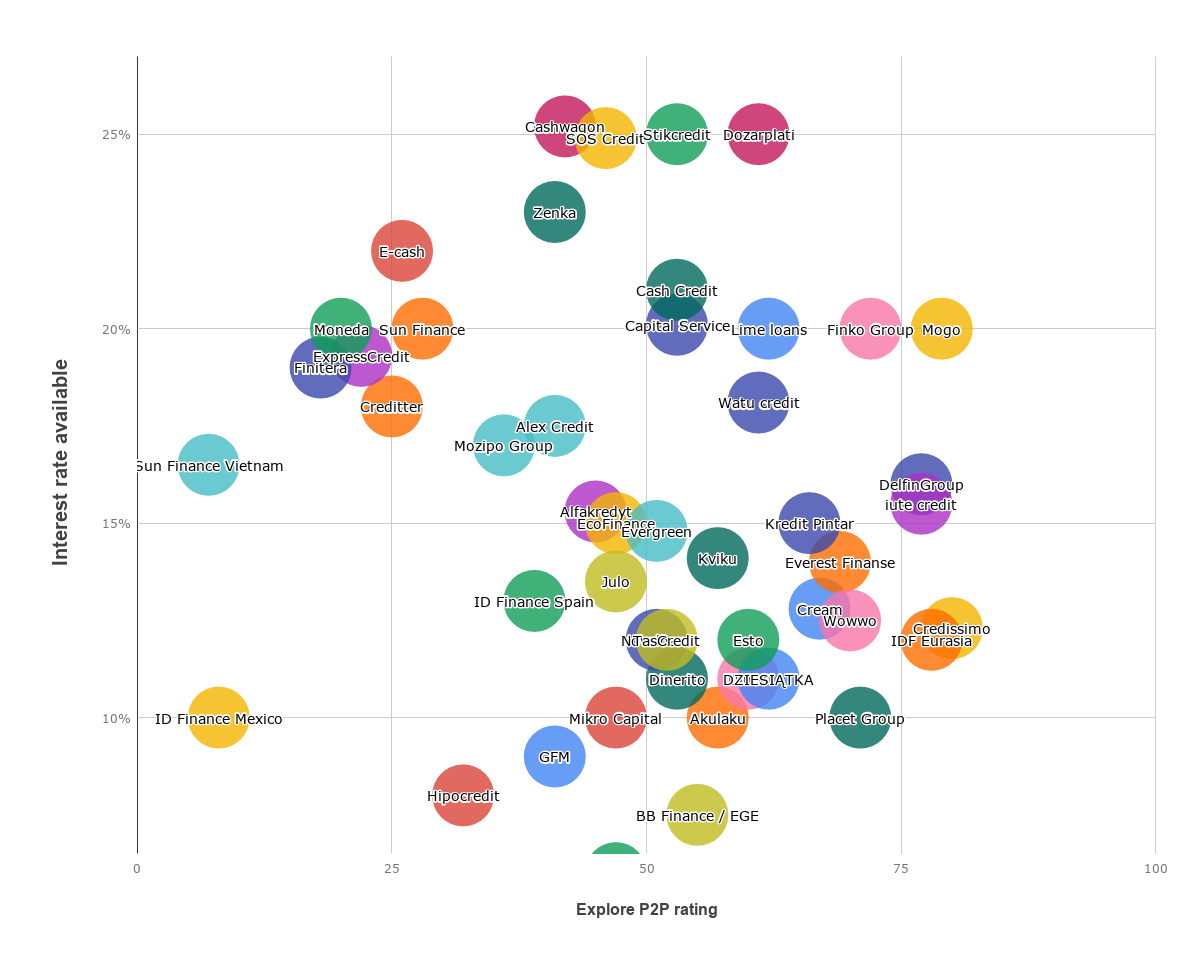

The chart below represents the loans available on the Mintos primary market as 23 March 2020. The vertical axis shows the typical interest rate that can be found from each lender. The horizontal axis represents the current rating score for each lender. The size of each bubble represents the availability of loans (low/medium/high). The most attractive loans are on the top right side of the chart, and the least attractive on the lower left side. The last time we updated this chart was in December 2019. We were talking about the large fall in interest rates, and reduced loan availability. The highest rates available then were around 13%. The chart and tables below show how dramatically things have changed. Rates of up to 25% can now be found.

As the COVID-19 pandemic progresses, finance companies will be finding funding more difficult to obtain. Clearly some are willing to pay high rates of interest right now to ensure that they maintain sufficient funding levels.

Rates available to investors are by far the highest they have ever been since the platform launched. Obviously these are also the most uncertain times too in terms of economic outlook. The chart above shows returns available, and current interest rates available. In the current environment, we think that choosing quality issuers is more important than ever. If you are considering buying loans from a lender, spend some extra time to get to know their business model, their financial position and how well positioned they are to deal with COVID-19 disruptions over the next months. Can they pay higher funding costs? Are they online, or do they rely on branches? If you can get comfortable with those answers, there are some very high returns available to take advantage of right now.

| Mintos Lender | Our rating | Interest rate | Availability? |

|---|---|---|---|

| Acema | 66 | No | |

| Aforti Holding | 50 | No | |

| Agrocredit | 47 | 6% | Yes |

| Akulaku | 57 | 10.0% | Yes |

| Alex Credit | 41 | 17.5% | Yes |

| Alfakredyt | 45 | 15.0% | Yes |

| BB Finance / EGE | 55 | 7.5% | Yes |

| Capital Service | 53 | 20.1% | Yes |

| Capitalia | 36 | No | |

| Cash Credit | 53 | 21.0% | Yes |

| Cashwagon | 42 | 25.0% | Yes |

| Cream | 67 | 12.5% | Yes |

| Credilikeme | 18 | No | |

| Credissimo | 80 | 12.3% | Yes |

| Credit Star | 79 | No | |

| Creditter | 25 | 18.0% | Yes |

| Credius | 68 | No | |

| DanaRupiah | 24 | No | |

| Debifo | 32 | No | |

| DelfinGroup | 77 | 16.0% | Yes |

| Dineo | 60 | 11.0% | Yes |

| Dinerito | 53 | 11.0% | Yes |

| Dozarplati | 61 | 25.0% | Yes |

| DZIESIĄTKA | 62 | 11.0% | Yes |

| E-cash | 26 | 22.0% | Yes |

| EcoFinance | 47 | 15.0% | Yes |

| Esto | 60 | 12.0% | Yes |

| Everest Finanse | 69 | 14.0% | Yes |

| Evergreen | 51 | 15.0% | Yes |

| ExpressCredit | 22 | 19% | Yes |

| Extra Finance | 52 | No | |

| Finitera (Kredo, Albania) | 23 | 19.0% | Yes |

| Finitera (Tigo, Macedonia) | 13 | 19.0% | Yes |

| Finko Group | 72 | 20.0% | Yes |

| FIREOF | 43 | No | |

| Get bucks / My bucks | 23 | No | |

| GFM | 41 | 9.0% | Yes |

| Hipocredit | 32 | 8.0% | Yes |

| ID Finance Mexico | 8 | 10.0% | Yes |

| ID Finance Spain | 39 | 13.0% | Yes |

| IDF Eurasia | 78 | 12.0% | Yes |

| ITF Group | 50 | No | |

| iute credit | 77 | 15.5% | Yes |

| Julo | 47 | 13.5% | Yes |

| Kredit Pintar | 66 | 15.0% | Yes |

| Kredit24 | 32 | No | |

| Kviku | 57 | 14.1% | Yes |

| LF Tech | 66 | No | |

| Lime loans | 62 | 20.0% | Yes |

| Mikro Capital | 47 | 10.0% | Yes |

| Mogo | 79 | 20.0% | Yes |

| Moneda | 20 | 20.0% | Yes |

| Monego | 34 | No | |

| Mozipo Group | 36 | 17% | Yes |

| Mwananchi | 54 | No | |

| Nexus | 45 | No | |

| Novaloans | 51 | 12.0% | Yes |

| Pinjam Yuk | 41 | No | |

| Placet Group | 71 | 10.0% | Yes |

| Rapicredit | 28 | No | |

| Rapido | 16 | No | |

| Revo Technology | 65 | No | |

| SOS Credit | 46 | 25.0% | Yes |

| Stikcredit | 53 | 25.0% | Yes |

| Sun Finance (Bino, Latvia) | 28 | 20.0% | Yes |

| Sun Finance (Dineria, Mexico) | 12 | 18.0% | Yes |

| Sun Finance (Kuki.pl) | 22 | 20.0% | Yes |

| Sun Finance (Simbo, Denmark) | 30 | 20.0% | Yes |

| Sun Finance (Tengo, Kaz.) | 13 | 20.0% | Yes |

| Sun Finance Vietnam | 7 | 16.5% | Yes |

| Swiss Capital | 40 | No | |

| TasCredit | 52 | 12.0% | Yes |

| Watu credit | 61 | 18.1% | Yes |

| Wowwo | 70 | 12.5% | Yes |

| Zenka | 41 | 23.0% | Yes |

Check out loans available on other sites

Bulkestate is a small but growing site focused on loans secured on real estate. It offers loans secured by real estate. Their rates are the highest in Europe for secured loans currently (11-14%)

Pingback: Wieso Privatanleger auf Mintos jetzt bis zu 15% verdienen - P2P

Pingback: How to Set Up Auto-Invest on Mintos | Jean Galea

Mintos added TAScredit.

Any score on them?

Thank you for your great research work 🙂

Hi Centrino. We added them yesterday. If you can’t see them on the post please try clearing your cookies/cache. We use it to load the page faster for you but there’s a chance it might result in you not seeing the updates straight away.

TAScredit still not there?

Wattu, Sun Finance, ID Spain high ranked? Credissimo – 23? What happened?

Hi Rodrigo – simple answer – there were some coding problems with an update we made yesterday. Thank you for pointing this out, we have now updated and fixed both. Appreciate it.

Pingback: P2P loans in a financial crisis - Marian Dreher • realestate.10ztalk.com

Pingback: P2P loans in a financial crisis | FinanciallyIndependent.eu

Great overview, but not up to date.

Last update says 6 september 2019, but Expresscredit for example still have a rating of 53, while you have cut the rating from 53 down to 22 in july/august 2019.

But still lots of info on this website, like https://explorep2p.com/mintos-lender-ratings/. Keep up the good work!

Hi Davy – you are absolutely right, we had not updated this for a while, and some of our ratings had changed. We’ve just refreshed it and we will keep it updated more often now..

Pingback: Mintos lenders are defaulting - here's 5 things you should know

Great page. Invaluable for helping in balance risk. What do you think about Mintos Invest &access? Could Mintos with their insider information be limiting or removing originators at risk?

Hi Johan. Thank you. Appreciate it. We don’t really like that product. We think a better portfolio can be created by only selecting the best originators. There’s a risk that investors are left with the loans no one else wants. In fact we did a post exactly answering your question.

Thank you very much for sharing!

Thanks for this Post!

Pingback: How to Invest 10.000 EUR in P2P? 15 Bloggers Reveal Their Best Ways!

Awsome work !

Thanks a lot !

Great job, I put it together with mintos and these loan originator/company missing:

efaktor S.A

Dziesiatka Finanse

Dozarplati

Extra Finance

Lime Zaim (as mentioned above)

Novaloans

Tengo/Capvia LLP

Banknote/SIA ExpressCredit

Credilikeme

hope it is helful

Hi Ondrej. Most of those are there (except Nova which is brand new and we are adding now). It seems a lot of people have different preferences in terms of exactly what to call each lender in the table, but we’ve done our best to provide the most obvious name that is consistent with the Mintos site.

Great Work. Thank u very much.

It Seems like u missed Out in adding Kredit Pintar to you Interest/Lender Raiting Chart.

Keep Up the great work. U helped me a lot! 🙂

Does anybody know why loans from Lime Zaim disappeared? What does it mean? Should I start to worry? I invested in their loans and they are all late. Mintos gaved them B

Pingback: Mintos Review 2019 - The Best Tips & How To Get Started - The Smart Investor

Pingback: Investice s Mintos – 4 Minutes Ago

Why Akulaku never appear on the rating tables? It’s strange.. Is B+ on Mintos..

https://www.mintos.com/en/loan-originators/akulaku/

Hi Oscar,

As a visual person, this is really quite helpful in determining who to reinvest with. Love it!

Matt

This is immensely helpful. I feel so much better with P2P now!

You could introduce a possibility to donate through paypal.

Hi Oscar,

I am trying to come up with a scoring system to determine the allocation for a portfolio of 100k EUR spread across buyback-guarantee lenders with your rating 50+.

The purpose of the scoring system is to come up with allocation(% of portfolio) to each lender. One challenge is that if the lender does not have enough available loans,my model would need to adjust accordingly.

Some of the metrics are: Your(Explorep2p) rating, Mintos Rating, Interest Rate*.

*On the ‘Interest Rate’ metric, basically as long as Explorep2p rating is good and Mintos rating is good, and buyback guarantee is in place, the higher the better.

My question is, what other metrics could I use in these calculations?

I am trying to model this in Excel, I’d be happy to share what I come up with when it’s done=)

Thanks!

Hi Mark. Sounds like a pretty good system already to be honest. You might want to think about other characteristics too like geography, loan types and so on. Diversification is good. Otherwise there’s a risk of being overweight pay day lenders in Central and Eastern Europe for example…

Oscar,thanks for your reply. I forgot to mention that geography would be Eurozone and currency Euro only. Are you saying to get more specific than that? If so, are there statistics on which countries are better? Same for loan types-are there statistics on which loan types have less/more defaults? And do I understand correctly that this becomes important only if a lender defaults on the buyback guarantee?

Can I somehow send you the Excel I come up with?

Thanks!

Hi Mark. The point made about geography is that some countries and regions are higher risk than others. Even if a lender offers loans in Euro currency on Mintos they may actually be operating in a different currency, and there is very little information provided about whether the lenders are hedging the FX risk that they have. On loan types – it can make sense to diversify between lenders that offer different types of loans. So, for example, if the payday lending market has issues, this may not have any impact on the secured car loans or mortgage loans that you hold. If you are relying on buyback guarantees the main focus is on whether the lender is performing well and whether they will be able to perform on their buyback guarantee. That’s why we started this page, because Mintos didn’t really make it clear to investors that it was the main risk they were running, and also that the quality of the lenders varies tremendously.

Also, noticed that your description for Bridgecrowd is incorrect here:

http://explorep2p.com/compare-platforms-secured-loans/

It’s for Mintos instead of Bridgecrowd.

Just trying to help=)

Woops! Thx for letting us know Mark, we’ve fixed the table now!

Awesome work guys!!! 🙂

Pingback: Best Mintos Auto Invest Strategy – Investor's Journal

Pingback: The Best European Peer-to-Peer Lending Platforms in 2019 | Jean Galea

It really looks like the rates are fluctuating wildly. Several lenders are back up to 12%, some of which are high volume (Varks), thus forcing others to also offer more, or miss out on backing. I’m wondering if this is just lenders testing supply/demand, or whether something actually changed on the market, like banks charging higher rates as well.

Look forward for update with new lenders like bbfinancegroup (https://www.mintos.com/en/loan-originators/bbfinancegroup/#general)

Hi Stan. We’ve updated our tables for BB Finance Group today, with an initial score of 62. We think they have some good metrics however it is hard to find their loans (some can be found if you set up an auto-invest to buy their loans).

Great work, it will be very useful.

Great work, thank you!

How do you calculate the lender rating?

Is there a rating threshold that you suggest don’t go lower?

Do you know which lender is actually profitable?

Thank you very much!

Hi Matteo. Thanks for the feedback. If you check out our Mintos lender ratings page, you can see all the financial information of each lender and how we scored each lender. The minimum score really depends on your risk appetite, but we think staying above a 50 score could help to significantly reduce investment risks.

Great overview!!

Thanks for sharing the informations!