Our pick of the best P2P loans

This post is part of a regular series where we highlight what we think are some of the best P2P loans available in the UK and Europe. These loans may have recently sold out. If they have, it is likely that very similar opportunities are available on each platform. Our goal is to highlight the types of opportunities that have been available on various platforms recently, and which types of loans offer the best (and worst) risk versus reward right now.

Description

Why we like it

Link

Interest rate: 11.4%

Term: 36 months

asset backed loan

LTV: 62%

LITHUANIA

This is a good example of the loans that are available on new P2P site HeavyFinance. It is a loan to a farmer that is being used to fund the purchase of two new pieces of farm equipment. The farm is profitable and is receiving subsidies from the Lithuanian government. The interest rate paid to investors varies based on how much is invested – from 10.7% up to 12.9%. The LTV is 62% and the equipment would have strong demand in the resale market if repossession took place as it is brand new. We like the diversification that HeavyFinance loans offer P2P investors – performance should not be impacted by deterioration in property markets, unemployment, or from Covid-19.

Interest rate: 11.5%

Term: 18 months

Personal Loan

BUYBACK GUARANTEE

Kazakhstan

Interest rates available on Mintos have been falling. That is because the demand for loans has increased as investor confidence returns. It is getting hard to find solid lenders offering rates of 10% or higher. Our Mintos selection this time is a loan from IDF Eurasia Kazakhstan. It is one of the few companies in the top third of our Mintos lender ratings page that still offers rates above 10% without having to invest in loans that have long maturities. The company has performed well over the last two years, making a profit of €5.8m in 2020. Its balance sheet structure is solid, and it has been able to issue bonds to institutional investors recently too.

Interest rate: 11%

Term: 24 Months

1st LIEN Secured loan

LTV: 35%

LIVANU, Latvia

This is a very simple loan. Simple loans are often the best. It comes from LendSecured. The borrower is a dairy farmer, who is seeking funds to grow his herd. The collateral is agricultural and forest land. There is currently strong demand for these types of land parcels in Latvia. The global shortage of construction timber makes the forest particularly attractive. The LTV of this loan is conservative, at only 35%. We think that an 11% return is more than satisfactory for the risk on this loan.

Interest rate: 16.4%

Term: 11 Months

Personal loan

buyback guarantee

bulgaria

Afranga is the new P2P site set up by StikCredit, which recently decided to leave Mintos. It has been offering very strong interest rates to encourage investors to follow them across from Mintos, which we do not expect to last too long. Rates have already been slightly cut from 18% offered at the launch of Afranga to 16.4% now. So who are StikCredit? They are a fairly small but profitable and well capitalised Bulgarian lender. See our ratings page for more details. We think Afranga will mainly be used by investors to add to their existing P2P portfolios to provide some extra diversification and extra yield. Given the returns available we think that could be a good option for many people.

Interest rate: 7.2%

Term: 12 Months

1st lien Secured loan

LTV: 50%

London, UK

This loan comes from SoMo (previously known as Bridgecrowd). This is a 1st lien loan secured on two properties in East London that require light refurbishment. The borrower lives in one of the collateral properties. The LTV is only 50%. We think that these types of loans are low risk and offer good returns relative to the risk level. The demand for SoMo loans has been growing a lot and their loans tend to sell out quickly. If you have large sums available to invest (min £5k per loan) then we strongly recommend checking them out.

Interest rate: 6.8%

Term: 12 Months

1st lien Secured loan

LTV: 60%

cheshire, UK

Demand for housing is currently very strong in the UK, with prices increasing quickly, particularly outside London. That makes us more positive than before about loans that have some development work required like this loan. A 4 bedroom house will be refurbished by a developer. Once completed they plan to construct another 4 bedroom house on part of the land plot. However that will take place after this loan matures, and we would expect the developer to be able to complete the restoration of this house and refinance this loan without too much difficulty. A rate of 6.8% seems fair for a loan with this risk profile. This loan is offered by Kuflink.

And here are three loans we DON'T like....

Interest rate: 7.5%

LTV: 59%

Term: 18 months

1st lien

Riga, Latvia

We think that EstateGuru are currently testing their ability to cut the rates they pay their investors and still fill their loans. While the risk on this loan is fairly low, we think that the interest rate is not competitive relative to alternative options available. The collateral is two apartments in Riga that are rented out to tourists by the borrower using Booking.com. We know that demand for these types of short lets has fallen significantly due to Covid-19 and the outlook is still uncertain. We saw recently a similar loan at Bulkestate with a lower LTV and a rate of 12%. That’s a huge difference in yield and that is why we encourage investors to open accounts on multiple P2P sites if they want to create the best portfolio possible.

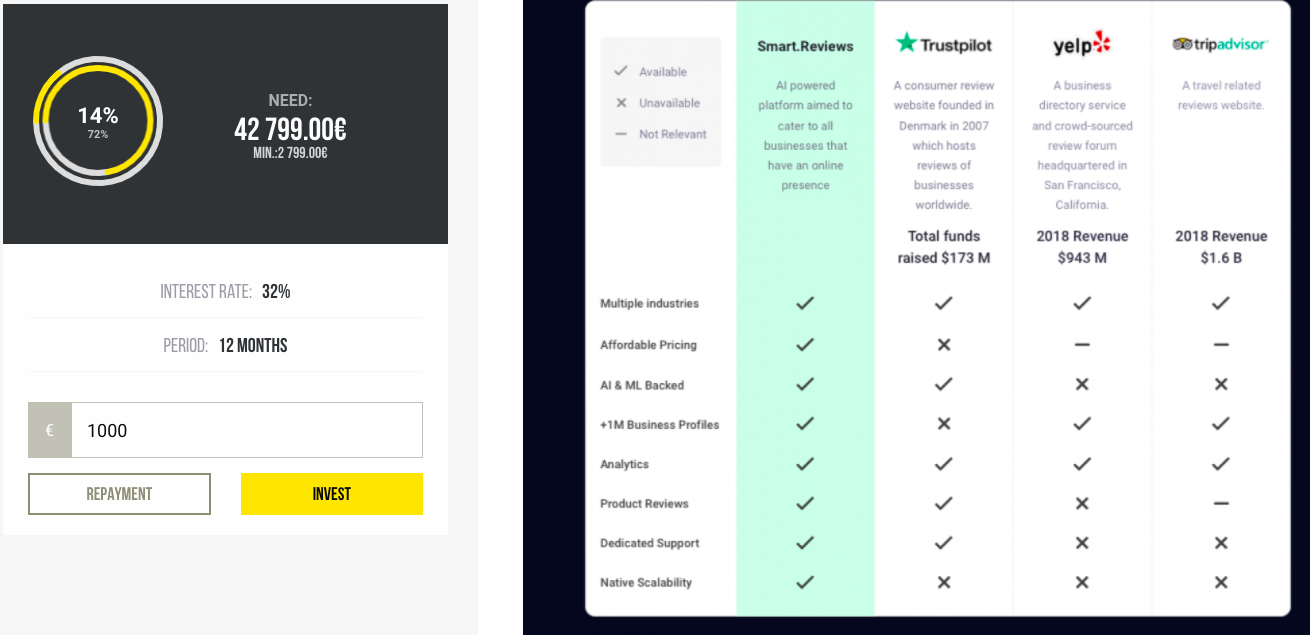

Interest rate: 32%

Term: 12 months

unsecured

Country: ?

We noticed that Crowdestor has finally published its lending statistics and they were every bit as bad as we were expecting. 67% of its current loan portfolio either has delays or is in recovery. Of course some of this is the result of the impact of Covid-19, but it is also because Crowdestor has always focused on high risk, high return opportunities. Unfortunately, they are continuing to list loans like this one here – with absolutely no financial information about the borrower provided. The borrower hopes to compete against highly funded, well known rating sites such as Tripadvisor and Trust Pilot. Do they have any chance of success? There’s nowhere near enough information available to properly assess this, but we have strong doubts. Effectively this loan is really a venture capital investment, but without any of the upside that venture capital investors receive to take on the high risk. We give this loan a one star rating.

Interest rate: 2%

Term: 12 months

partial guarantee

Country: france

October is another P2P site that focuses on lending to small and mid sized businesses. However they focus on lending in Western European countries such as France, Italy and the Netherlands. This loan is to a company providing digital marketing / SEO assistance. The interest rate is only 2%. Why? No doubt that this is because it is advertised as having a government guarantee from the French Government. However, the fine print says that it is only a guarantee of 90% of the principal. The company made a significant loss in 2020 and has the worst / highest risk rating of C- from October. The company says that it was impacted by Covid-19 but we are not convinced by this explanation. Spending on digital marketing grew strongly in 2020. The quality of the company’s website is very poor – not what you would expect from a company that says it is an expert in this area. The 2% interest is nowhere near sufficient because there is a high default risk which will most likely result in a loss of interest and 10% of principal for investors.

If you are interested in any of the loans above, please make sure to read all the information provided by each investment site and make sure that they are suitable for you. While we aim to highlight potentially interesting opportunities, you must perform your own assessment of the risks and make your own independent decision on whether to invest, and whether these, or similar loans offered on each site are suitable for your investment objectives. All information is supplied in good faith based on information which we believe, but do not guarantee, to be accurate or complete; we are not responsible for errors or omissions contained therein. Explore P2P is not a financial advisor and no content can be or should be considered to constitute financial advice. All content provided is for informational purposes only.