P2P lenders can fail - here's what to look out for

Over the last 18 months there have been two notable failures by P2P lenders in Europe. Eurocent, a Polish lender that issued loans on Mintos failed, and is being liquidated. It appears that this was mainly a result of poor lending quality, which led to funding difficulties. Collateral UK, a British lender that operated its own P2P site, was closed down by British regulators earlier this year. The circumstances behind this closure have still not been made fully public, but it has led to a substantial risk that investors in this platform will not be able to fully recover the amounts they invested in this site.

P2P investing involves risk. Lenders can sometime fail unexpectedly. However, there can often be signs that things are not going well for a lender prior to it failing, if you know what to look for. Below, we’ve listed some of the most common warning signs that a lender is at risk of failing.

#1 - Financial information provided is out of date or inadequate

This is one area where we feel the P2P industry needs to significantly improve across the board. Many sites fail to provide adequate financial about loan originators. There is no real way for P2P investors to make an informed decision about whether to purchase a P2P loan unless they have access to recent, and adequate financial information.

When things are not going well, management can be tempted to postpone releasing this information as long as possible. That’s why we pay close attention to any lenders that have not provided any financial updates for a very long period of time (yes that includes you, Twino).

We’ve also noticed that many under-performing lenders will often produce powerpoint presentations full of photographs and useless information, but will fail to explain or even discuss why their business is losing money, or how their loan portfolio is performing. If you can’t see any discussion or analysis around lending performance or profitability, that’s a concern.

#2 - The business starts to shrink

We pay close attention to the overall growth rate of each lending business. Moderate growth is ideal because it suggests that the business is operating successfully and without any significant changes. High growth can often be the result of changes to credit policies, or the introduction of new loan products, both of which have a long history of going wrong.

Even worse than high growth, however, is negative growth. There’s two common reasons this happens. When defaults start to increase unexpectedly, management are often forced to reduce lending to ‘stop the bleeding’. Negative growth can also indicate that a lending business is finding it difficult to obtain funding, forcing it to reduce its lending.

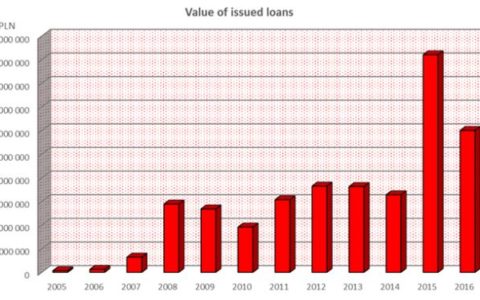

The chart opposite shows the growth profile of Eurocent prior to becoming insolvent in 2017. It had both excessive growth in 2015, followed by negative growth in 2016.

#3 - Bad debts start to increase significantly

All lenders suffer bad debts. It’s a cost of doing business. If they become too high, this can cause lenders to fail. Excessive bad debts can cause lenders to run out of capital, get closed down by regulators, or run short of cash when funding facilities are withdrawn.

There are many metrics professional investors use to assess the lending performance of a business. Simple ones, that most lenders make available to P2P investors, include the percentage of loans that are delinquent (‘non-performing loan ratio’), and also the ratio between interest income earned and loan loss provisions (the cost of bad debts). If either of these deteriorate, it can be a sign of trouble ahead.

New or fast growing lending businesses require extra caution. It takes time for bad debts to become apparent, so it can be easy to show acceptable levels of credit losses and non-performing loans when a lender has a lot of newly issued loans in its portfolio. It tends to take at least 3-4 years of operations for any lender to demonstrate properly whether its credit policies and lending scorecard are working or not.

#4 - Shareholders don't provide enough capital

Keep a close eye on the amount of shareholders equity (capital) each lending business has. Well capitalised businesses are less likely to fail, and capital also protects creditors (including P2P investors) from losses if they do fail.

We focus on the amount of equity a lending business has as a percentage of the loans it holds. For smaller lenders we like this to be at least 30%, and for larger lenders at least 20%. Banks tend to have less capital than these levels, however they are also better regulated and are much less likely to be allowed to fail.

We also look at the absolute amount of capital a lender has. We are sceptical of any lenders with capital less than €1 million, regardless of what country it operates in. Lenders with very low levels of capital are a big concern to us. It suggests either that the business is very small and lacks sophistication round critical functions such as credit decisions, or that it was not able to find shareholders that could provide it with meaningful amounts of equity backing.

What are the key warning signs that a lender is heading for trouble? If a lender makes a substantial loss, and does not raise any capital to cover it, this can often indicate that it lacks support from shareholders, and the business is likely to fail.

#5 - Losses

Losses are bad. Everyone knows that. But some types of losses are worse than others.

Many lending businesses have good prospects, and good lending margins (net interest income after deducting bad debt costs), but they are just too small currently to cover their operating costs. However, if they are growing, and have appropriate amounts of capital, this is not particularly concerning to us.

However, if a lender is well established and it has falling profits or makes losses, this can be a clear warning to investors that things are not going to plan and in most cases a signal to pull money out.

#6 - Employees leave or get fired

Professional investors keep a close eye on any changes in the key management teams of companies they invest in. CEOs and CFOs don’t tend to leave companies that are performing very well. It’s also worth monitoring any press reports of large redundancy programs. Any announcements about staff changes can provide some insights into how well a company is performing. If you have a large amount of cash invested into any single P2P lender or investment site, it can be helpful to subscribe for Google news alerts for any public information that becomes available about them.

#7 - Share / bond prices start to fall

Most European P2P lenders are currently fairly small and use private sources of debt and equity funding. However, some of the larger P2P lenders are listed on stockmarkets (examples include Funding Circle, MyBucks) and/or have issued public bonds where trading prices can be found fairly easily (such as Mintos lender Mogo). The number of public securities linked to P2P investment sites will grow significantly over the next 2 years.

In the chart shown to the right, we can see that the share price of Mintos lender MyBucks has been steadily falling for some time, and is down 60% since April 2018. However, in the case of another Mintos lender Mogo (chart far right), its bonds have been consistently trading close to ‘par value’ (currently around 99% on a 9.5% coupon bond), which suggests that professional investors currently do not have concerns about the ability for Mogo to repay their bonds.

If you own loans issued by any companies with public securities, we think it is worthwhile paying attention to what is happening to their trading prices. Falling prices will indicate that professional investors have doubts about future prospects of the lender, even before any bad news may have been public. In situations like this, we think it pays to follow the smart money, sell first, and ask questions later.

Thank you for this post. You discuss some interesting details in there. Regarding the dangers of extensive growth, however, a couple of questions emerge. Mintos itself shows enormous growth, which does not concern me however. Not sure about the magnitude, but Varks also seems to grow quite fast, which is more difficult to judge I suspect. I see your point though – Varks might be at increased risks due to the big growth, and it remains to be determined whether they can control the risks that come with it, right? Do you have any opinion on either Mintos or Varks? When you collect all the financial information throughout time, do you consider growth or shrinkage do be a factor for the ratings?

Lastly, the share prices from MyBucks are most likely correlated with the general market, I don’t think one can judge that in isolation, at least it does not seem fair, or does it?

Again, great post, and lots of things to discuss!

Hi Christian. We have no concerns about platforms like Mintos growing quickly as they are not lenders themselves. In fact the faster they can get big and become profitable, the better for investors. On MyBucks – if a stock has just fallen in line with market that’s not a concern. However if a stock has fallen 60% in a flat market environment, it’s worth taking another look.

Very good post. Thanks!