The Mintos Secondary Market can help investors boost their returns and manage risk

European P2P investment site Mintos offers their investors an opportunity to purchase loans from the lenders (‘Primary Market’) or from another Mintos investor (‘Secondary Market‘). The Secondary Market currently has more than 150,000 loans listed for sale – that’s bigger than the Primary Market which has around 100,000 loans for sale. Since November last year there are no fees for using the Secondary Market, which has made it more attractive for investors.

What are the advantages of using the Secondary Market?

There are 3 main potential advantages for using the Secondary Market:

- It can be difficult to find loans from some of the best lenders on the Primary Market. Many investors have set up their auto-invest function to buy loans from certain lenders. Demand can exceed supply, meaning that it can be difficult to find these loans on the Primary Market. The Secondary Market can offer supply of hard to find loans. It is particularly useful for investors who have just opened their account and want to deploy their funds quickly

- Yields available can potentially be higher than on the primary market. Some investors are looking to raise cash quickly by selling their loans, and may offer some attractive deals

- Loans on the secondary market have extensive payment history information. Investors can be selective, and choose borrowers that have excellent payment histories

We think it is very important for Mintos investors to consider using the Secondary Market. It can boost returns, provide liquidity, and help to reduce risks. We’ve listed below some tips to finding the best loans, and avoiding some potential pitfalls that exist when using the Secondary Market. If you have some other recommendations we would love to hear them – please put them in the comments section below.

1. - Compare the returns on the primary and secondary markets

Suppose you are interested in buying loans issued by a lender called Banknote, with a term of around one year. You could go to the Primary Market, where interest rates offered are 9.3%:

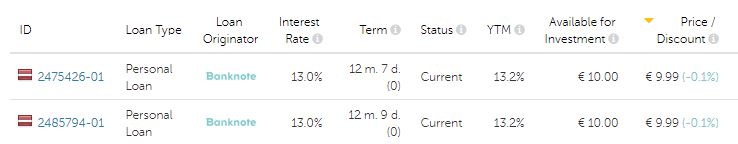

Alternatively, you could go to the secondary market. Loans are available there at a 0.1% discount, and the yield to maturity is 13.2%. The loans on the Secondary Market are very similar. They have a current status (i.e performing), and have a buyback guarantee, just like those on the primary market.

Clearly, in this situation, it makes more sense to buy the secondary market loans. We see these types of yield differences often on Mintos. Some lenders have been reducing the interest rates available on the primary market, but loans can still be found on the secondary market at the higher interest rates, with much better yields to maturity.

2. - Don't pay high premiums, even if the yield is attractive

Sellers set the prices of loans on the Secondary Market. The price can be set at a premium or discount to the claim amount of the loan. For each loan available for sale, Mintos lists the interest rate of the loan, and the Yield to Maturity (‘YTM’). The YTM is the return the investor will make assuming that the premium or discount is paid, and the borrower makes the scheduled remaining payments.

Many loans are listed with high premiums (above 3%). This generally happens when an investor is selling a loan with an interest rate that is higher than can be found currently on the primary market for that lender. The YTM for these loans may still appear to be attractive and generate a higher return than can be found on the primary market. However there are two potential pitfalls with paying a high premium. Firstly, if the borrower repays the loan in full, or faster than scheduled, the return for the buyer will be less than the YTM. If the borrower repays the loan in full quickly, the borrower could even make a loss.

Another potential pitfall is that Mintos lenders have the right to repurchase the loans at any time at par. In fact, one lender, Hipocredit recently did this. Many of their loans had been trading on the secondary market at big premiums, and Hipocredit’s actions generated losses for many investors who had bought these loans on the secondary market.

We therefore recommend avoiding loans with premiums greater than 3%, to avoid the risk of large losses from early repayments or buybacks.

3. Only purchase loans from the best lenders

There are currently loans available from 34 different lenders on the Secondary Market. In our view, there is a big difference in quality between these lenders. Our Mintos lender ratings have been developed to help identify the best ones. Why does it matter? Many of the loans feature buyback guarantees if the loans default. One Mintos lender has already run into financial issues and has been unable to honour this buyback guarantee. This is likely to result in significant losses for Mintos investors who purchased their loans. We think it is important to avoid lenders with higher risk characteristics, such as small size, weak balance sheets, and a history of losses.

4. Review payment histories

If a loan has no buyback guarantee, finding loans with a low risk of default is very important. Mintos allows loans to be filtered based on their status. For example, loans that are ‘current’ can be selected. We recommend using this filter. However, it’s important to go a step further and review the payment histories of loans that are available. We will show why below:

The loan above has a ‘current’ status. By reviewing the payment history, it can be seen that the borrower has made every payment on time since the loan began. This suggests that the borrower is not in any financial distress and is diligent at repaying the loan. This is the ideal loan profile to purchase on the Secondary Market.

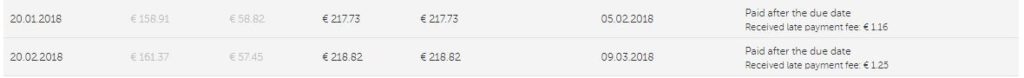

The loan above also has a ‘current’ status. However the borrower has a record of paying late often, which suggests that they may be experiencing financial stress. Loans with this kind of payment profile have a higher risk of defaulting in the future. However, this borrower recently caught up on their payments, so it also has the ‘current’ loan status. More sophisticated investors tend to try and sell loans like this as quickly as possible once they return to current status. In this case, an owner of the loan has placed it for sale with a small discount, to try and attract buyers. However these are exactly the types of loans to be avoided on the secondary market. The potential discounts that can be found are generally not worth the extra risk these loans represent.

5. Use the filters to find the best offers

The only way to find the best loans on the Secondary Market is to make heavy use of the filters provided. It is best to start with a vary small number of loans that meet all your requirements, and expand if necessary, than to not use enough filters and be left with thousands of loans to look through.

The most important filters to use initially are ones such as currency, status (we suggest only selecting ‘current’ loans), term, and premium/discount range.

This will still leave a large number of loans. The next step is to decide whether you want to buy loans with buyback guarantee, or with no guarantees. For buyback guarantee loans, it’s recommended to make sure that you purchase loans from several different lenders. Also look to buy loans from lenders that are highly rated.

For loans without buyback guarantees, loan to value (‘LTV’) is an important filter to use. The lower the LTV, the lower the risk of the loan. Also consider using the amortization method filter. A loan that is fully amortizing has no refinancing risk at the end of the loan, and the LTV will fall faster over the life of the loan, which reduces the risk for the investor.

The final step is to rank the selected loans by YTM, and select the loans that have the best combination of YTM, payment histories and collateral quality (where relevant).

1% bonus offer for new Mintos investors

If you have not yet joined Mintos, we can help you to boost your returns further. If you visit Mintos using this link, and open an account, Mintos will credit your account with an additional 1% on all funds invested within 3 months from opening an account. We think it is a great offer, from of Europe’s best P2P investment sites, and is only available using this special link.