Lendermarket is the funding arm of international finance company Creditstar

Lendermarket is a lending marketplace that was been set up by the international finance company Creditstar in 2019 to help fund the growth of their business. Creditstar has placed its loans on Mintos for several years, and currently continues to do so. However through sign up bonuses and higher interest rates it has been encouraging investors to invest in their loans via Lendermarket. Creditstar has experience operating through tough economic environments, as it was established in 2006, shortly prior to the last financial crisis. It operates in 8 countries with the largest markets being Poland, Spain, the UK and Estonia. It has been consistently profitable for many years. Creditstar offer ‘near-prime’ loans – the average interest they on their loan portfolio is 32%, which is higher than banks charge, but lower than sub-prime and payday lenders. It is a modern style of finance company, offering loans through digital channels only, with a heavy emphasis on data analytics.

Lendermarket is a sister company of Creditstar. It is owned by the same holding company that owns Creditstar. It is owned by Creditstar founder and CEO Aaron Sosaar. Creditstar has 120 employees, and Lendermarket has 5.

Creditstar had a very good year in 2019

We have reviewed the recently released interim (unaudited) results for Creditstar for 2019. Profit after tax doubled, to €5.8m. Creditstar generated an average return on equity of over 25%, and a return on assets of over 5%.

One of the key things we look at is the stability of bad debt costs. Since 2013 for Creditstar these have been consistently in the region of 5-7% of outstanding balances, which is a pretty good result given the average yield on loans that the business is earning (32.5% in Q4 19).

Another thing that is important for investors is how secure and diversified Creditstar’s funding is. This is an area that Creditstar seems much better placed than many loan originators that offer P2P investments. Their portfolio has five funding sources – bonds, credit lines, private loans, P2P and owners equity. Creditstar’s bonds have maturity dates between 2020 and 2022, with. a significant proportion maturing after 2020. This diversification of funding sources and maturities left Creditstar reasonably well positioned going into the current challenging environment.

Omayra, can we start by asking you what your role is at Lendermarket? What is your background?

My academic background is in Law and Business. Previously, I have worked in Creditstar Group, where I learned the dynamics of the consumer loan industry. My position at Lendermarket is Business Manager, however as the team is small, my role is to cover different business functions according to the needs.

Who else is involved with the management of the Lendermarket platform?

Given the size of the company, Lendermarket does not have a top management position appointed yet. The strategic guidance for the business is given at the shareholder level, from the ultimate beneficial owner that also owns Creditstar Group who also initiated Lendermarket. Given the availability of experienced staff and know-how established in Creditstar Group, Lendermarket gets additional advisory on needed areas (such as marketing, IT development) from Creditstar. For that an outsourcing agreement between these two companies has been concluded, which specifies the use of expertise and scope of resources Creditstar Group is devoting for Lendermarket.

Can you please confirm the ownership structure of Lendermarket, and the relationship between Lendermarket and Creditstar?

Lendermarket and Creditstar Group are sister companies, both belonging to the same ultimate beneficial owner [founder Aaron Sosaar].

Is Lendermarket being run simply to be a funding tool for Creditstar, or are there plans to develop it and make it a multi-lender platform (similar to how Peerberry has developed)?

In the near term future we do not envision the introduction of additional Loan Originators to the platform. However, we do not rule it out as an option in later stages.

How much capital does Lendermarket have? Will the shareholders be able to provide more funding if needed?

The shareholders of Lendermarket are providing funding for Lendermarket activities. As the company has relatively recently started its operations and is still setting up further processes, the shareholders are supporting it’s growth until the set-up phase is completed. If needed, shareholders continue providing funding also after set-up phase completion.

Why was Lendermarket set up in Ireland? Are there any operations there or was this just done for tax or other reasons? Where are actual the Lendermarket operations based?

Ireland met the regulative criteria that the business development team established while working through various countries. And additionally, what was very important to us – an English-speaking environment. As our working language is English within the company, then we preferred to establish the business in the country, where we’ll be able to interact with the regulator directly in English. In comparison with Ireland, the UK, for example, would have proved to be more difficult in terms of the regulative environment. Therefore, ultimately the choice of establishing the business in Ireland came down to multiple deciding criteria. Lendermarket’s team is international and currently based in Estonia.

Creditstar used to fund its P2P loans on Mintos – why did they decide to set up Lendermarket? Is it cheaper than paying fees to Mintos?

We at Lendermarket do not have a full knowledge of all the ins and outs of Creditstar’s strategic decisions. However, here are a few objectives that we are aware of:

– Reducing risks arising from the platform. To give an example, in case that the platform has multiple loan originators, then whenever there would be a situation of anything noteworthy happening to any given competing originator, there’s a chance that the whole of the platform’s operation gets affected. Also, then the performance of Creditstar’s funding may suffer, while the company has no direct involvement in such a theoretical incident.

– Lendermarket also offers another source of funding for Creditstar, that is in benefit of its diversification.

– Getting better first-hand feedback from end investors and what’s important to them. In case of a non-related third party platform, there may still be something that’s “lost in translation” or that the loan originator won’t get to be aware about. Whereas Lendermarket’s team and Creditstar Group’s team can set feedback exchange principles in a more flexible manner.

At this point the overall cost of funding is similar when comparing Mintos and Lendermarket.

What can you tell us about the profitability and performance of Creditstar for 2019?

The main takeaway is that Creditstar increased their net loan portfolio and revenues while growing profit. To put it in figures, Creditstar increased their net loan portfolio by 36% to 113.2 million euros and revenue by 31% to 31.7 million euros while doubling profit to 5.8 million euros.

Another element to highlight of their annual report 2019 is that the amount of cash in the balance sheet has increased 50% compared to Q4 2018. Also, Creditstar continues decreasing the percentage of loan impairment charges to total liabilities and equity, from 5.28% in 2018 to 4.65% in 2019.

Creditstar seems to be growing its balance sheet quickly. Did it raise any new equity in 2019? Does it have plans to raise any in 2020?

Creditstar indeed increased equity in 2019 in the form of converting retained earnings into larger share capital. The share capital was previously 9.75 million euros while now it is 21 million. Additionally, as an important source of funding, Creditstar completed two bond issues in 2019 – in May and in December.

Do you have plans to launch any new features or products on Lendermarket this year? What changes if any can investors expect?

We maintain a pipeline of developments, many of them were or are planned to be implemented thanks to user’s feedback. In the near future, we will publish a section at Lendermarket’s website with several statistics and data of the platform.

Are you subject to any regulations in Ireland? If so what authorisations does Lendermarket have?

According to the set business model of Lendermarket, we do not require any authorisation (or a license) as a retail credit firm, credit intermediary, investment firm, or bank/credit institution from the Central Bank of Ireland. The main regulatory requirements with which Lendermarket needs to comply are those relating to anti-money laundering. The requirements of the Criminal Justice (Money Laundering and Terrorist Financing) Act, 2010 which transposes the EU’s Third Money Laundering Directive into Irish law.

How will COVID-19 impact Creditstar?

The CEO of Creditstar has made a statement about COVID-19 here. We have also read further statements from him elsewhere on the topic. The key themes are their experience of operating in a challenging environment (2008/09) and the online nature of their business, which allows the business to operate with less disruption than traditional finance companies. The company will need to offer some flexibility to its customers as they suffer a temporary drop in income and available cash to service their loans.

In our view these statements are both reasonable and true. But how is COVID-19 likely to impact Creditstar, and how well placed is the company to navigate the next 12 months? We think three key things are likely to happen. Firstly funding will become more expensive and difficult to obtain. However the business has some protection from this due to the bonds that have been issued at fixed rates. Secondly, the level or arrears and bad debts will increase. Finally, we would expect the business to reduce the amount of new lending it does, which will lead to a smaller loan portfolio and interest income. We also expect the management team to take measures to reduce operating costs.

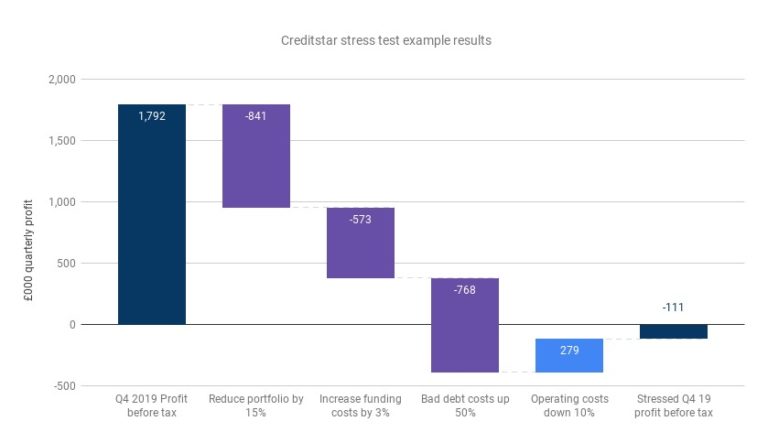

What happens to Creditstar under 'stress' conditions?

To test how resilient Creditstar may be to COVID-19 in the coming months we decided to perform a ‘stress test’ simulation of their latest quarterly financial results. We made some assumptions that we thought could potentially reflect conditions for the business for the rest of the year, based on conditions during the last financial crisis. We ran 3 stresses at the same time – a decrease in the loan portfolio of 15%, an increase in funding costs of 3%pa, and a 50% increase in bad debt costs. To make the scenario a little more realistic we assumed that management would respond by reducing operating costs by 10% (they could probably reduce these by significantly more). When we model the results of these stress assumptions, Creditstar’s Q4 19 profit of €1.8m turns into a small loss of €0.1m. Our conclusion from this is that Creditstar’s strong underlying profitability and the high yield it generates on its portfolio means that it appears to be fairly well positioned to cope with the challenges ahead. It’s impossible to know how conservative (or not) these stress assumptions are given the current uncertainty. We also don’t have full details about the maturity profile and key terms of all its funding facilities. But investors can gain comfort from the amount of equity that Creditstar holds (over €25m), and its successful track record that could help it raise additional equity if needed. All these factors make Creditstar appear to be one of the strongest European loan originators available for P2P investors to purchase loans from right now.

2% bonus offer available for limited time

Lendermarket is currently offering a 2% cashback bonus for all net deposits made until April 30, 2020. Interest rates are typically between 12 and 14%. To take advantage, just use this link, open an account and invest in loans prior to April 30. Your account will then be automatically credited with your bonus.

Hello Oscar,

Kristaps just posted a new article, showing the lack of transparency from Creditstar about a serious audit :

https://kristapsmors.substack.com/p/creditstar-no-audit-no-problem/comments

1- aren’t you concerned by this lack of audit?

2- if you are, do you plan to reflect that on your score for Credidstar?

Thanks for your reply!

Hi Centrino – yes we have read that post, thanks. We will wait to see the company’s response to Kristaps before taking a view.

Great Oscar, let’s see if Creditstar ever answers…

But in case of not, I think this lack of official audit should be reflected in the score > being largely decreased…

Regards

As you may have seen elsewhere, Creditstar have confirmed that they have appointed KPMG now as their auditor. The 2019 audit is ‘official’ – their auditor was registered at the time. Ideally they would have used a bigger and more reputable auditor prior to now. They say the change was delayed due to Covid. Not sure if that explanation makes total sense, but at least there is a firm commitment now going forward.

Thank you ! Fingers crossed then 🙂

Pingback: Lendermarket review - Alternative Investments

Pingback: Is Creditstar still solid? We talk to their CEO Aaro Sosaar

The Group Credistar has good performance but terrible communication.

I have invested money in Lendermarket and Mintos, about 10k but I decided to withdraw all is as soon as possible.

If the management will drive the company as they are doing with the investors, in a few months they will close.

Rob,

Thank you for confirming what we have observed the lasts weeks; i.e. :

1- no proactive communication from them towards the investors ;

2- no reply (or at least not detailed enough) to the list of questions we had to prepare ourselves (due to point 1) ;

and no payments to investors 🙂

Like you, I’ll withdraw all what I can as soon as I can.

Regards,

Centrino

Dear Centrino,

I also will withdraw my money IF I can.

Regards,

Hugo

>>Q: do they plan to retroactively add loan extensions to their expired EE loans on Mintos?

They just did it on my Spain loans, so I guess it’s a yes. I’m now stuck for two months more with old 10% loans when the same on Lendermarket are 14+2%

I just got the interests, paid instantly (no Pending Payments).

…and my Poland loans too. Creditstar finally implemented the Extension API on Mintos, I guess globally.

No news = bad news.

Hopefully not ?

We’ve been promised the responses tonight.

Great ?

At least we’ll then know what to expect in the coming months ?

Hi Oscar,

Have you received the responses?

Kind regards,

Hugo

Well well well…

If a CEO can’t keep his promises about answering legitimate investors questions at the due date…

How the hell can it take so much time to provide answers…

Anyway, this confirms to me the bad impression I had about this platform…

Not to mention that since 1,5 months, I didn’t receive any cent from them (300+ loans invested)…

So logically I am planning to withdraw all my investments as soon as I have the occasion to do it.

>>1- is it normal that since 1,5 months I didn’t receive any cent from them

Not “normal”, but legit under the current circumstances. I’ve received zero too, and zero from Robocash.

>>2-and when can we expect some payments ?

Maturity+60 on Lendermarket. For Mintos, it’s getting longer due to Pending Payments.

Just wanted to confirm we have answers from Mr Sosaar but wanted to follow up on a few points. Hopefully will be able to publish something soon.

Great Oscar !

At least we made some progress. While at the same time it seems like their answers are some kind on vague…

Anyway, with the answers you already received, can you answer my 2 basic questions :

1- is it normal that since 1,5 months, I didn’t receive any cent from them (300+ loans invested) ?

2- and when can we expect some payments ?

Thank you in advance,

Centrino

It’s here https://explorep2p.com/creditstar/

Hi all,

I am trying to understand the chart on this link about Creditstar/Lendermarket 1st june bond: http://cbonds.com/emissions/issue/572847 but I am not able to figure it out. Can anyone help me with these questions:

– Where is the scale?

– Why, until the Covid19 crisis start, the three lines go down? I guess this is related with the 11% coupon going down with the time… but I am not sure.

– If the the bid price is, for example, 60% does it mean that there is a 40% probability of bankrupcy?

Regards,

Florein

cbonds only shows you all the numbers if you are a paying subscriber. There are always fluctuations to prices of bonds, although without seeing the scale it’s impossible to know if the decrease i 1%, 10% och 50%.

The 11% coupon stays the same, although the nominal value may be decreased if the loan is being paid off.

if a price drops to 60% of the original and it’s very close to maturity, then the market believes that it’s only worth 60% of book value. This isn’t the same thing as 40% probability of bankruptcy since one also needs to take into account available assets which might be available for creditors after bankrupcy, although either way it’s really bad. For a longer maturity one needs to calculate the new yield to maturity to get a sense of how risky the 60% price is.

If you want to look at historical default rates in relation to credit scores I think the Wikipedia page is quite interesting:

https://en.wikipedia.org/wiki/Bond_credit_rating

Keep in mind here that Mogo has a rating of B- from Fitch which qualifies as “highly speculative”, and this is one of the highest rated loan originators on Mintos. What many people don’t realize is that many of the smaller loan originators have such an extremely poor credit rating they can’t issue any bonds or take bank loans. It’s a miracle for them they have been lending through P2P for interest rates far below what professional investors would ask for.

When can we expect answers Grom lendermarket?

Indeed ANDRZEJ good question, one week later, when can investors expect clear answers from CreditStar / LenderMarket ?

As ideally and ironically, it is Credistar who should have one month ago already communicated formally about the current situation (as opposed to use having to contact them after their radio silence…)

– since one month now : all loans are frozen / extended / whatever status they call it…; hence we see no single euro paid; hence the account value is frozen; hence investors can’t even withdraw some money to invest it on another platform which still pays interests…

– even more critical : Creditstar / LenderMarket leaves their investors in the smog; we have had to contact them on our own; receiving different answers, but no formal communication from them about the changes they made and how they will improve the payments schedule in the future, etc…

In summary, from my perspective :

1- I’m really (really) disappointed by this platform;

2- with no formal and positive communication from them next week, I’ll probably consider withdrawing a big part of (if not all the) money from the platform.

Regards,

Centrino

They have just sent an email about the issues to all Investors.

While Creditstar on Mintos has big Pending Payment problems for EE and FI loans, I faced zero bad surprise on Lendermarket, I don’t get what is disapointing about a 14% yield, zero default (so far) investment in the heart of covid crisis. They didn’t change any rule, the buyback still works and widthdrawals are still intraday. Maybe that’s because i’m used to Robocash that works this way from day one, but 100% late loans is very normal under such conditions. On both platforms, Overdue mostly means “extended”, not “unpaid”.

Still, they need to urgently fix the Pending Payments on Mintos, people there are losing patience. And after Denmark, they now have another dangerous branch: Poland. Add covid-suspended Spain, the list is getting long.

Hello JMN,

Concerning “Overdue mostly means “extended”, not “unpaid”.

I agree. But even if extended, aren’t we supposed to receive some payments (interests) every 30 days? Or do I miss something?

Thanks for your reply

Hello,

1. On Mintos, yes in most cases (unless extensions are aggreed with no interrests payments by borrower, which should never happen except Force Majeure like covid)

2. On Lendermarket, not for short term loans.

3. On Robocash, never.

Since 2. and 3. have no Grace Period, Term Extension or Pending Payment, you’ll receive all accrued interrests after buyback.

Hi Andrzej and Centrino. The questions are with the CEO and hopefully won’t be too much longer. We’ve been following up. In the meantime there’s been an email from Lendermarket to all their investors noting that the various government forbearance measures have led to repayment extensions being granted to borrowers but they have committed to paying all the interest that is due in the interim, and the buyback provisions remain in place. Lendermarket have also been publishing update blogs here.

Thank you Oscar for pointing us to their blog post! Interesting read.

So, we all stay tuned ?

Enjoy your weekend!

My biggest concern about Creditstar is that the current average pending days on Mintos is 12 days! Only other companies with big problems have similar ratings, such as Finko (10), Capital Service (11) and Peachy (14)!

Would be great to hear a statement from Creditstar addressing this question.

Is it just me, or is the repayment of this, their biggest outstanding bond, in just 2 months perhaps an explanation behind the potential liquidity crunch?

25 mill EUR 1st of June.

http://cbonds.com/emissions/issue/572847

Refinancing could not come at a worse time?

Agree they are unlikely to be issuing any new bonds in the next couple of months. They raised 20 mill in November/December which was meant to be to ‘fund their growth’. Given the current market circumstances it is likely that they are instead shrinking their portfolio and will use those funds to pay off their June bond. Will see if they can confirm this for us.

And so, do you think we still have to invest in new loans ? Or should we pause our auto-invest during a certain period ?

Thank you for your advice…

Well you don’t ‘need’ to invest in any loans at all, and shouldn’t if it’s causing any concerns. We will see if we can get a comment from the Creditstar CEO about their funding plans over the next 6 months, and when they can improve their reporting of loan status to Lendermarket.

Hi Oscar,

Please, let us now if Lendermarket wants to answer your request. In the meanwhile I think you should take out the bonification link.

Kind regards,

Hugo

Hi Everyone – The Creditstar CEO has agreed to respond to questions, which we will publish the answers to. If you would like to propose any questions please list them here and we will try to include as many as possible. Topics already likely on the list include bond refinancing / liquidity plans, impact of Denmark rate cap, COVID-19 impacts on customer behaviour, and why are so many loans showing late on Lendermarket for some investors.

Thank you for your effort Oscar !

I would rephrase your last sentence, from

‘why are so many loans showing late on Lendermarket for some investors’

into

‘why end march, 100% of the loans were marked are late (on the web site) / overdue in the report. And when can these payments be expected ? i.e. in 60 days ? or earlier ?’

Thank you again for assisting us – we really appreciate it 🙂

Centrino

How many months of liquidity does Creditstar have, if current economic conditions persist?

Hi Oscar,

I would like to know who would be paid first in case of Credistar bankruptcy. In what position are the Lendermarket’s investors? If Credistar shareholders have to put more money into the company to save it… will the Lendermarket’s investors lose money?

Is there in Poland any new law related to coronavirus crisis that allow borrowers to delay the payments? How is it possible that almost 100% of my loans are overdue? In the worst scenario, I can imagine that 20% of the borrowers have paid their loans. Are Creditstar owners taking Lendermarket’s investors money to cover their loses?

Kind regards,

Hugo

Q: do they plan to retroactively add loan extensions to their expired EE loans on Mintos, as Varks did, for the same reason (lack of support of Extension in Mintos API)?

Q: Does a new investor cumulate the 1% Welcome bonus and the 2% cashback, totalling 3% ?

Hi Oscar,

How much money has Creditstar raised via Lendermarket? Which percentage represents this amount from all the money sources of Creditstar?

Thanks in advance,

Trs22

Dear Mr. Harrington,

I have seen in the comments that Creditstar has to pay a bond on 1st june and that this is a really big payment. My loans would be 60 days overdue before 1st june so they should be buybacked. I would like you to ask Lendermarket management what are they going to do if they have liquidity problems. Are they going to pay Lendermaket individual investors or take the money to pay the bond?

Best regards,

Jean Louis

Hi Jean Louis. Absolutely, we have sent a list but that was question number 1.

This is indeed THE question to ask in first position.

Because again this weekend, I had 50 30-days loans arriving at maturity. And again : total payment = 0 ?

Is it possible that you could get their Q1 results before the bonus period expire?

Of course it would be unaudited, but still they have to be in pretty bad shape to cook the books, så Q1 is definitely better than anything.

I really hope Creditstar is just hoarding liquidity to be on the safe side, but we investors have seen a bit of everything by now, so it is too dangerous to just hope for the best.

Oscar,

As you suggested, I sent an email to LenderMarket. Here their official answer :

******************

Starting in mid-March, Creditstar offers more flexibility to borrowers with active loans and future clients. We trust their almost 14 years of experience that include the crisis of 2008, and they know that being proactive with clients has yielded positive results in terms of the quality of the loan portfolio and clients who pay their payments on time.

The measures consist of discounts on extensions, restructuring and more appropriate payment schedules. Unfortunately, those changes cannot be reflected in the payment schedule at Lendermarket due to technical limitations. Meaning that if a borrower has extended the repayment date, investors will see the loan delayed. While there is still no technical solution available at Lendermarket to reflect such modifications on the platform, we hope to introduce this feature in the near future.

Nevertheless, every week there are loans repaid, and I’m confident you will start receiving repayments this week. I hope you can be understanding with this exceptional situation. Both Lendermarket and Creditstar are working to minimize the impact of the coronavirus on our businesses.

Best regards

******************

> Question : what is still unclear to me is if (or when ?) I will receive payments for my 200 loans (invested 30 days ago, on 28/2) that arrived at maturity on 28/3.

Maybe you can shed my / our light ?

Thank you in advance Oscar 🙂

You will receive zero on 28/3 and all 60 days after. Again, Lendermarket is like Robocash, loans and related events are opaque, if an event happens (delay, extension, default) you don’t know and the loan get repaid after the 60 days (30 for Robocash).

One difference, Lendermarket can make intermediate partial payments, and coupon payments, while Robocash is all or nothing.

They now list tons of long term DK and SE loans, up to 3 years, and stopped Spain. @Oscar what’s your opinion about the DK loans? You warned against them for Mintos.

Hi Jerome. The concern with Denmark was that the government parties had announced plans for a 35% interest rate limit. That will mean short term loans in Denmark will probably not be profitable any more. If a LO only operates in Denmark that’s a big problem. For Creditstar it’s less of a concern because they operate in many countries, and Denmark is a fairly small part of their operations. That new law doesn’t seem to have gone into effect yet though because the Creditstar Danish site is still offering loans at rates of around 180% right now…! We will try and find out what the situation is regarding their operations and the new law there.

The law will be implemented 1/7/2020.

The strange thing is that Creditstar launched in Denmark when it was already known that there would be some regulation, at with out centre-left government already ruling when Creditstar launched in Denmark, it should be expected to be a rather low APR.

Rules in short: You can only advertise loan up til 25% APR., the APR can at most be 35%, but you can’t advertise in public for loans with APR>25%. The borrower can never pay more than 100% in interests and fees.

Thanks to everyone for their question suggestions for the Creditstar CEO – we’ve now submitted a selection of them and will publish the responses.

I read all those comments, all interesting, and i’m only surprised with the 100% late comment. I’ve been investing in Lendermarket for the last 6 months, still have 5k there and here is my current status:

Current

4 413.57 €

– 1-15 days late

289.85 €

– 16-30 days late

556.82 €

– 31-60 days late

107.46 €

So definitely not 100%, more 25%. Half of them are expiring in 3 days now, so i’ll see in what status they turn.

Hello Alex,

Thank you.

I think that looking at the past 6 months is not correct to compare with the current situation.

Let’s see what happens with your loans expiring in 3 days. But I would guess 100% of them will fall into ‘overdue’.

But keep un informed please !

The more we share the information between us, the more we will learn about what is currently happening at LendenMarket (seen that they seem to give different / vague / ambiguous answers).

Thank you and staf safe !

My numbers

Current 3 298.60 €

– 1-15 days late 1 200.00 €

– 16-30 days late 517.62 €

– 31-60 days late 0.00 €

(34 % late)

I had 350 due on March 27. (the all went into late status)

app. 1.000 is due April 4.

Thank you Joe for your statistics.

They seem to confirm that 100% of the loans where maturity = end of march are falling in ‘overdue’.

all 1.000 from April 4 is now in fact overdue. No money was returned to my account.

The statistic is unfortunately lying. They are still registered as current, but without an Estimated Next Payment Date.

Let’s see what they will answer to Oscar…

With me, every single loan is delayed. I only get paid if the buyback takes effect after 60 days. But on time. It’s been like this since mid-March and Corona. The large proportion is still in arrears in the first month. So let’s see what happens then. I wrote to Lendermarket support days ago. No Answer.

One should not forget that this article here at p2p explore is advertising and not critical journalism. Hence the answer: “this seems almost impossible”. And no critical questioning. A journalist would never advise you to inquire about it yourself, but would put yourself behind.

Hi Andreas, we are following up with Lendermarket, but as we don’t have access to the details of individual investor’s accounts it makes sense that Lendermarket provides specific feedback to each investor too. That’s why we suggested that investors get tailored responses.

Hi Oscar, nice post

But I think you are »missing« a very important point (which is a problem for all companies like Creditstar). It’s the liquidity, what is this company going to do, if f.x. by law they are forced to extent existing loans (to an unknown future date) and the funding is shrinking (that is us taking our money out of the platform). In the beginning they can stop making new loans, using their profit etc., but those sources will all run dry. So they will have a lot of (uncertain) prolonged loans and missing funding. This cocktail can kill even the best business. All it takes is one person/company going to court for bankruptcy. (indirect you have the liquidity issue incorporated in the higher interest rate for funding; but the problem could be that no matter how high interest rate you use in the calculation, nobody is willing to make the funding).

So a stress test would be improved if it included some kind of measure, which states Creditstars long and short term funding. (You have some info in the text about bonds etc.).

PS: I’m invested in Lendermarket (Creditstar) and not moving funds out. I’m also seeing an increase in overdue loans.

They are all Spain loans, hasn’t Spain, by law, suspended all loans due to Covid? It could explain, and also why no new loan has been listed since 17-mar.

I expect a Robocash scenario as when their PH originator lost its licence: all loans to be repaid but the very last day at D+60

Same for me, 100% of my loans are Overdue, except a few old long-term Finland ones.

While it happens to be normal for Robocash (loans are rarely paid on schedule, often very early or very late), it was rare from Lendermarket.

Also why does Creditstar lists long-term 18% loans on Mintos, with a lot of Pending Payments? They talk about the now famous Mintos “IT-Glitch”. Sadly it reminds me a lot of Varks.

Please ask Lendermarket team for an explanation and let us know what they say. Statistically this seems almost impossible unless there were a small number of loans in the portfolio, so it feels like there could be a reporting problem. Agree investors don’t want any ‘glitches’!!

Theso call glitch is the exact same story as Varks: they want to retroactively turn no-extension loans into 6-extension to keep capital. Varks did it, and defaulted 4 days after. I don’t predict a default here and i continue to reinvest into Creditstar but i don’t like retroactive changes.

This is for Mintos Creditstar, on Lendermarket they legitimately use Overdue status for extension, like Robocash.

Hello,

If Lendermarket is the safest places to allocate funds right now… time will say.

According to my experience currently is not.

As of today, 98% of my loans are in ‘late’ status. For me it looks like Creditstar is saving liquidity on the back of the investors.

Independently I think a lot of improvement are necessary (like: statistic page, Blog, Secondary market)

Hi Tom that seems very strange, we have not seen anything similar on the test account we have been running for the last 4-5 months. Perhaps it’s a data issue, definitely worth asking the Lendermarket team what the situation is there with your account.

I ignore if what Tom wrote is true.

But my 200 30-days loans invested on 28 feb were overdue on 28 March. I.e. 100% of them 🙂

Please ask Lendermarket to explain and let us know what they say! That doesn’t make any sense…

That was the answer i recived from them:

Hello,

I’m able to share updated information from Creditstar’s side:

Firstly, we see that a significant majority of the overall outstanding portfolio that we have on Lendermarket platform is continuously in the “current” status. It is definitely an exception, when the investor’s portfolio indicates that most of the loans are overdue. The statistics across our whole portfolio that is allocated to Lendermarket does not support that.

However what has changed during the recent weeks, is that from Creditstar’s side, we do not exercise as broadly as we used to, the option to rebuy loans before the due date. In general, it is an approach we are sometimes using, according to our corporate finance objectives. But in order to maintain higher financial reserves and being therefore able to provide flexibility to many of our active customer groups, we are not using the early rebuy approach at the moment.

And we have been focusing on providing Creditstar’s customers solutions such as discounts on grace periods, restructured and better suited repayment schedules. While at the same time there isn’t a technical solution available just yet at Lendermarket to reflect such modifications to the platform, which in cooperation with Lendermarket’s team we are aiming to change in near periods.

Therefore, it may occur that some amount of loans will remain on the platform until the activation of Buyback Guarantee. And of course continuously receiving interests while the repayment is delayed.

Dear Oscar,

I think that you should update your post with this information… maybe people are investing more money using your link (that, IMHO, you should take out until this issue would be totally clarify).

I would really thank if you can request an officil statement from Credistar/Lendermarket management team. As I have said in a previous comment this is a HUGE RED FLAG.

Kind regards,

Hugo

Dear Oscar/Tom,

The email response recieved from Lendermarket by Tom is a total bullshit. They have received payments from some of the borrowers and they are not paying any. They say it is the best way but at the same time they have launched a new bonus campaign to take more money from investors. I think this is very dangerous.

As I said before, if you have the chance, it would be very helpfull if you speak directly with the management and ask for a official explanation. I guess none of us will receive a good one. If you do not receive this info you should take out the bonus link.

Kind regards,

Hugo

Hi Tom,

I have exactly the same situation that you are explaining. I have requested more information but I have not received any response. This is a HUGE RED FLAG. They are taking our money to cover their losses.

Kind regards,

Hugo

Also there’s the thing that because I’m Polish I can’t invest in Polish loans on the platform.

Hello , i would like to know why Credistar does not publish loans from countries such as Finland or the Czech Republic on its Lendermarket platform and only lists Spain and Poland. As a Creditstar investor I would prefer to have all the loans from all the countries where the company operates rather than dividing my investments between Lendermarket and Mintos.

thanks

Finland loans have been published on Lendermarket in the past. All the loans have a Creditstar guarantee so it doesn’t matter too much which country the loans are located – the biggest bet is that Creditstar will stay solvent and power through the next 6-9 months.

Indeed Oscar.

What I just found ‘peculiar’ (so to speak), is that for the moment, Credistar loans have bigger interest rates on Mintos vs on LenderMarket (while it was the opposite 3 months ago).

Regards,

Centrino

Thank you for your reply!

Thank you Oscar !

This is good news to read.

Do you know why for the moment there are only loans for Poland and Spain, while there are other countries listed in the auto-invest ? Might this change in the future ?

Thank you advance, and regards

They have had some other countries available in the past weeks, such as Finland. But countries like Poland are one of their largest markets. We’ve been told that they don’t offer loans from some of the countries that Creditstar operates because the portfolios in some countries are fairly small and fully funded with other sources.

Thank you for your reply!