EstateGuru is selling shares on Seedrs

EstateGuru is a European P2P site based in Tallin, Estonia. It offers loans secured against all types of real estate. It is currently closing another funding round on the crowdfunding site Seedrs. The company has a new valuation of €49 million, with plans to grow in many European countries. We have included them in our list of Top 10 P2P sites in recent years. We thought that makes now a good time to perform a new ‘deep dive’ analysis of their lending record so far. We wanted to confirm – is their lending performance still satisfactory? Which types of loans are higher risk? What returns have investors really been achieving? Has it been successful lending outside its home Baltic region?

What can we learn from their data?

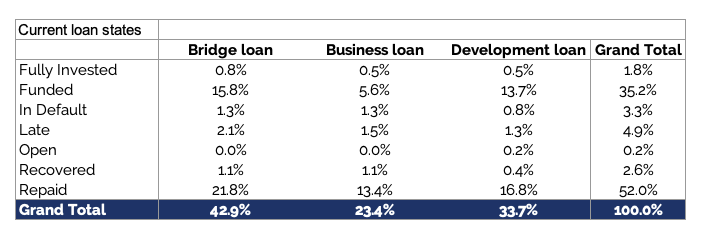

We downloaded from EstateGuru a data tape containing the history of every loan they have issued since 2014. As of May 2021, EstateGuru had issued €361 million of loans. It makes three types of loans – bridge loans, business loans and development loans. The table below shows the current status of all loans issued (percentages shown are calculated by loan amounts). Borrowers have repaid just over half of the loans. 37% of loans are in good standing. The rest are late, in default, or went through a recovery process.

While this is an interesting overview, we need to drill down further into the data to see what’s really going on.

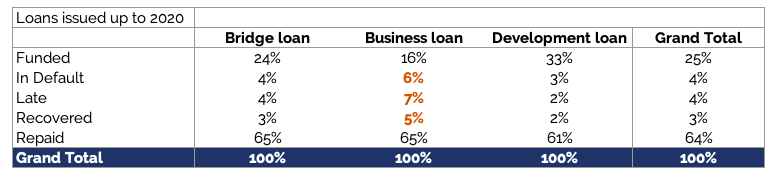

Business loans seem more likely to default

The table below shows the current status of loans issued up to and including 2020. While the % of balances repaid is fairly similar across the three types of loans, a much higher percentage of the remaining business loan balances have a late status or are in default. 5% of loans have also been through a recovery process.

What’s likely to be the reason for this? One reason could be that EstateGuru is not the first place many businesses would turn to for a business loan. EstateGuru is often providing loans to businesses that cannot obtain loans from their banks. The business loans are often used to provide working capital for companies that are running short of cash. Both of these factors may be reasons for higher levels of default risk, which we can see in the table below.

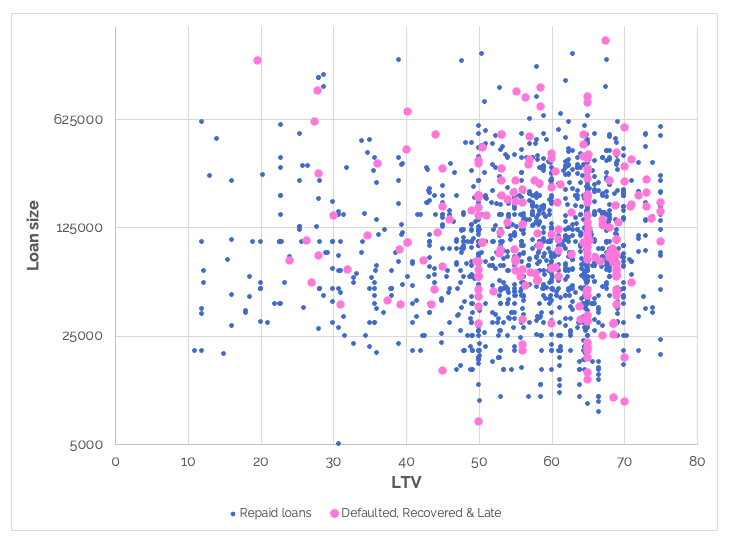

Loan size and LTV are poor predictors of whether a loan will default

The blue dots on the chart below represent loans that have repaid. The pink dots represent loans that are currently late, in default, or went through a recovery process. The vertical axis shows the loan size (with a log scale) and the horizontal access shows the LTV. It is surprising to see no correlation at all between loan size, LTV and the probability of a loan becoming delinquent. The only pocket of loans that had very low levels of delinquency were the low ultra-low LTV loans (below 25% LTV).

This tells us two things. First, even fairly low LTV loans can still run late or default – borrowers may run out of funds even if they have equity value in the collateral property, and no refinance options. Second, larger loans don’t appear to be riskier – the probability of default appears to be fairly consistent across all loan sizes.

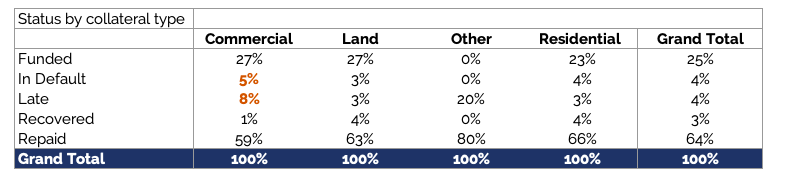

Some collateral types have underperformed

The table below shows the loan states based on collateral types, for loans up to and including 2020. We can see that commercial loans have experienced slightly higher levels of default than other assets such as residential. Until mid -2019, EstateGuru provided a breakdown of the types of commercial properties that were collateral. When we analyse these sub-groups of commercial collateral, we can see that some types of commercial properties have had high rates of default. 51% of loans secured by warehouses and logistics centres either defaulted or went into recovery. 14% of retail / restaurants defaulted. Many of these loans will have been classed as business loans, which we saw above were riskier. We have also noticed in the past that many of the warehouses that have been collaterals in the past have been lower quality properties that were fairly old. This could be a sign that the borrower may be operating with tight cash flows that is more likely to default.

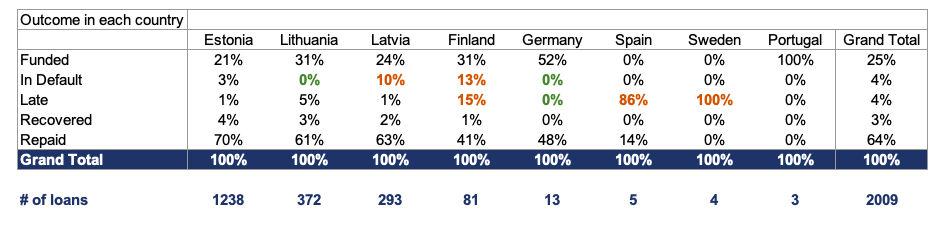

Latvia and Finland loans have had higher levels of default

The table below shows the state of loans issued in each country (percentages shown based on loan amounts). Estonia is by far the largest lending market, followed by neighbouring countries Latvia and Lithuania. More recently, EstateGuru has launched in Finland, Germany, Spain, Sweden and Portugal. While only a small proportion of lending, these countries are a major driver of forecast growth of the EstateGuru platform, and one reason provided to justify the valuation of the platform.

Lithuania and Estonia have similar levels of performance, when we consider the total proportion of loans that are in late, defaulted and recovered states. Latvian loans have significantly underperformed in comparison, with 10% of loans currently in default. Finland however, is the country that appears to be causing real problems for Estateguru, with 13% in default and a further 15% late. We are not too surprised however. Many of the loans offered in Finland have had lower grade collateral. Finland also has a more developed banking system, making EstateGuru more likely to be a ‘lender of last resort’ than in the Baltic region. As only 81 loans have been issued so far, we admit however that we need more time and more data to know whether EstateGuru can operate successfully in this country or not.

It is also too early to analyse the lending performance in other countries such as Germany, Spain, Sweden and Portugal. However the management team will clearly be disappointed with the percentage of late loans in their first loans in Spain and Sweden so far.

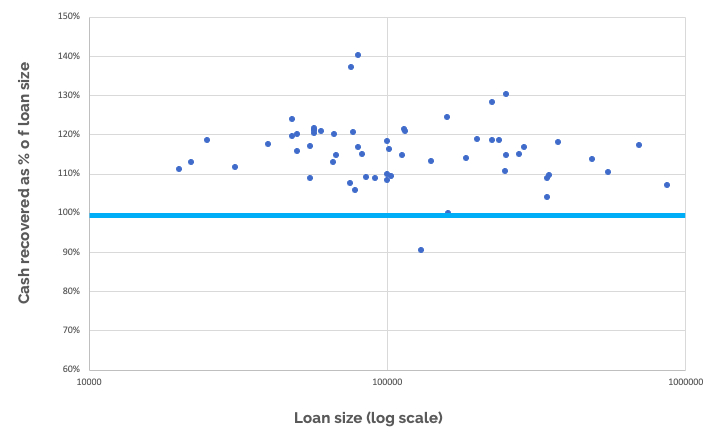

Recovery rates have been excellent so far

We have analysed the amounts received back by investors on loans that have gone into recovery status (i.e once a loan has defaulted and the collateral has been sold). A recovery rate of 100% represents a full recovery of principal with no income for investors. The chart below shows the recovery rates for investors so far. As you can see, most investors have received between 105 – 125% recoveries. This is an extremely impressive track record. Only one loan has recorded a loss (of 10%). Recovery rates are fairly consistent across all loan sizes.

Does this mean then that even if loans default, investors should still expect to nearly always get their money back, plus accrued interest? Not necessarily. That’s because for every loan that has been recovered so far, there’s another that is still in ‘default’ status. There’s a risk that the loans that have not been recovered yet may have collaterals that are more difficult to sell, have lower values than expected, or may have some legal issues preventing recoveries from collateral sales.

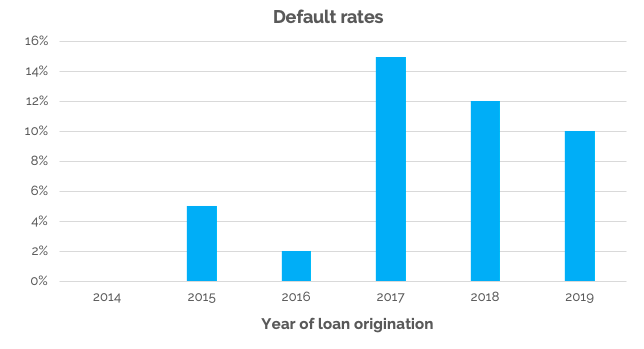

10-15% of loans have been defaulting

When lenders grow their loan portfolios quickly, it often makes the lending statistics they publish look much better than they really are. That’s because it takes time for defaults to come through. If a portfolio comprises mostly new loans, the overall proportion of defaulted loans will seem very low. Rather than looking at the overall portfolio data, it is much better to track how well the older lending vintages are performing.

In the chart below, we show the performance of loans originated in each year between 2014 and 2019. The default rate shown is the percentage of loans (by balance) that are either currently in default, or have been through a recovery process. We can see that default rates were very low from 2014-2016, but have increased quite significantly over 2017-2019 to between 10-15%. We expect that the 2019 default rate will continue to increase and will end up similar to the 2018 level. What about 2020? It’s too early to estimate a likely default rate for loans issued last year. We know that 3% of loans have already defaulted and a further 9% are in a ‘late’ status. It seems likely that default levels will end up similar to 2017-2019 levels.

Investors in the 2017-2019 vintages have quite high percentages of defaulted loans that have not yet been recovered – 7% of 2017 loans, 4% of 2018 loans and 8% of 2019 loans. The recovery rates on these remaining loans, and the length of time it takes to obtain those recoveries, will have a large impact on the overall net returns investors will make on the loans they purchased during this period.

Is this a good lending track record?

Overall, we think that most investors will be pleased with their experience so far with EstateGuru. The weighted average interest rate has been 11%. So far, investors have only realised a (small) loss on one loan. However, there are still fairly high levels of 2017-2019 loans that are still in default, making it difficult to estimate the average net returns of investors so far. If EstateGuru continues to generate recoveries greater than 100% on its defaulted loans, the net returns will be 10%+. Our best estimate, after reviewing all the data, and considering the remaining levels of defaulted loans, and the likelihood that recovery rates will fall, is that a 8-10% average net return will have been earned by investors. We think that is an acceptable return for this type of risk profile.

However, we think there’s potential for more sophisticated investors to earn higher returns than this, if they avoid some of the higher risk types of loans we have identified above. That includes avoiding or reducing:

- Business loans

- Loans in Finland and new countries such as Spain until a solid track record is developed

- Loans secured on lower quality commercial property, particularly warehouses / logistics assets

Sign up bonuses for new investors

New EstateGuru investors can earn a 0.5% bonus on investments made within 90 days of opening a new account. Just visit EstateGuru using the link provided and you will automatically qualify for this promotion.

Many P2P sites like EstateGuru have been offering investors the chance to buy shares through the crowdfunding site Seedrs. Many other types of investing opportunities can also be found on the site. Seedrs is offering new investors a £25 bonus. You just need to invest at least £150 (or Euro equivalent) within 30 days. Just visit Seedrs using the link provided and you will automatically qualify for this promotion.

Once again an excellent job, I calculate my investments very deeply and you save me a lot of time and work. Thank you very much.

You are welcome Jose Luis!