We've reviewed the financial statements of 28 British P2P firms

Earlier this year we analysed the most recent financial statements provided to Companies House by 28 of the most important British P2P firms. We wanted to know how much equity had been invested into each platform. How much did they have left? Were they profitable? Before investing in a platform we want to know that it will still be around in a few years. Looking at the amount of equity, and profitability are good short cut ways to assess this. We will provide the profit data in a future post. The numbers we discuss below are ‘shareholders equity’ (the assets less liabilities of the firms). Please note – some of the platforms may have published updated financial information since we pulled the figures during March-May this year.

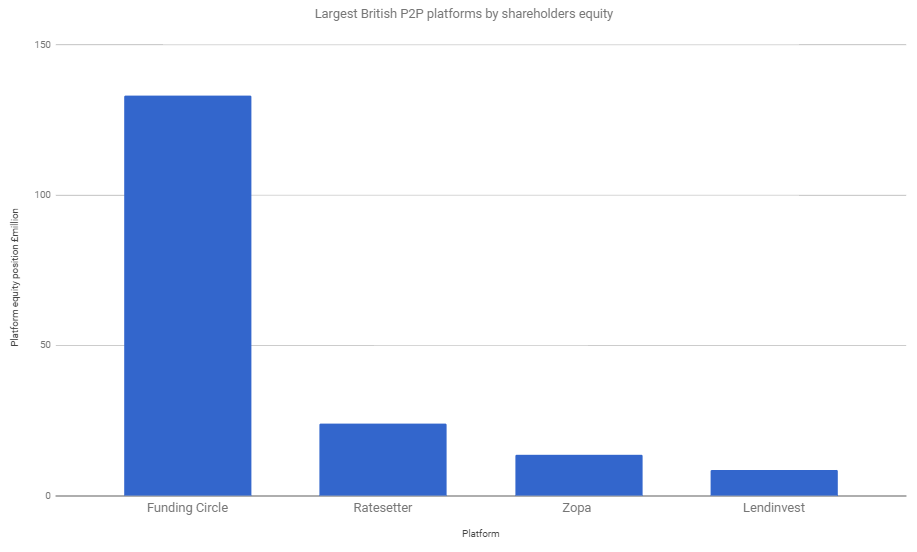

93% of the total equity is held by 4 British P2P firms

Funding Circle, Ratesetter, Zopa, and Lendinvest combined represent 93% of the total shareholders equity disclosed in the most recent financial statements of British P2P firms. Lendinvest is currently profitable, the other 3 firms are currently loss making. Funding Circle has been raising equity at strong valuations from investors, it is also generating the largest losses of any British P2P firm.

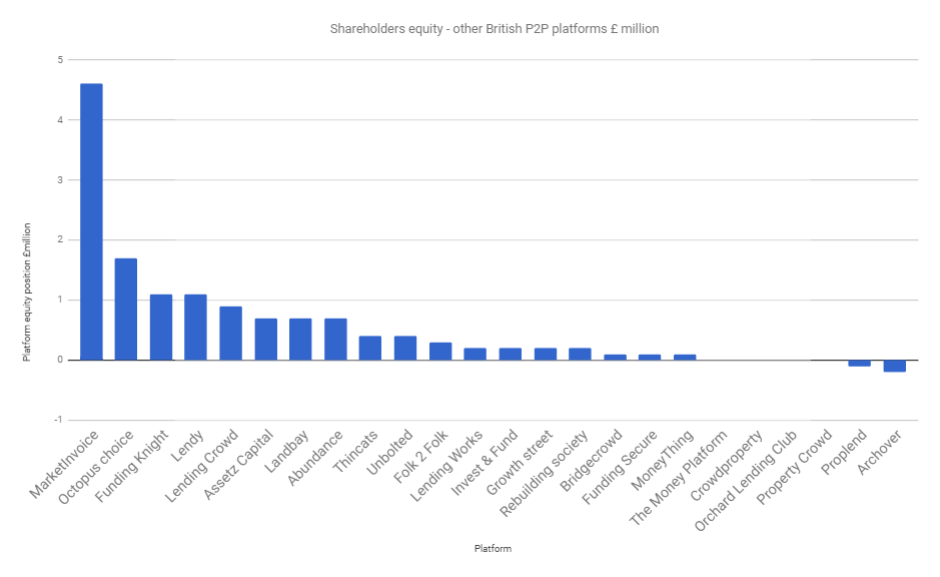

The amount of equity held by the remaining firms is modest

The chart below shows the amount of shareholders equity of 24 British P2P platforms. It is clear that the amount of equity held by most platforms is modest and in a few cases negative. In some cases the platforms were new and had received very little initial investment, and in others the platforms had been making losses which were being covered through additional equity injections.

Equity is just one factor to look at when assessing a platform....

The data we provide here can help to provide a picture about the size and prospects of a platform, but several other factors need to be considered. In particular we tend to look at:

- Who owns the business? Is it part of a larger financial group? If so this is positive as it provides a source of future equity. It also creates important reputation issues for the group if they let the P2P platform fail.

- What are the lending volumes, and what is the trend? Altfi provides very useful data for many platforms here Altfi volume data. Platforms need a certain volume of lending to be profitable, if lending is falling or is very small this is generally not a good sign

- Has there been a recent equity raise, how big was it, and what was the valuation? In many cases the figures provided by Companies House are outdated, and the platform may have received additional equity since the last financial statements were submitted. Many P2P firms have been raising equity at high valuations, which suggests that investors are confident in the future of the business. These are frequently reported in the business press or specialist websites. Another question is whether investors have been injecting funds to cover recent losses? If no injection was made either during, or immediately following a loss making year, this is not a good sign

- Is the business profitable? If not how close to profitability is the business? What is the trend?

- Are current investors happy with the platform? A few minutes reading the sub-board of the platform at the P2P forum can be valuable. Look for reports of rising defaults, slow processing of withdrawals, and poor customer service

Final thoughts on the equity levels held by P2P firms

Generally, we feel that most British platforms should be more strongly capitalised. We would not be surprised to see some mergers take place in the coming years. As volumes continue to increase, we expect many platforms to reach profitability and build their equity levels. We expect most of the platforms to have additional rounds of equity raising until they reach a solid trajectory. It’s clear however, that for now, all investors should pay close attention to the performance of each platform, and make sure that they diversify their investments across many platforms. Some of the platforms we list above may not find a profitable business model, and may need to wind down, or merge with another platform. In the meantime, we will continue to keep a close eye on the public disclosures made by the platforms.