It's a perfect time to check your investment portfolio

It’s the middle of summer. A good time to recharge the batteries, read some books, and to think about things other than work. It’s also the perfect time to perform a check up on how you are investing your wealth and savings, and to make sure it is best positioned for the next 12 months.

When was the last time you analysed exactly how much of your wealth is sitting in different asset classes? Not just the amount of cash invested into P2P sites, but also the value of deposits, equities, property, pensions and so on? It’s an exercise worth doing, because the results can often be much more different than expected. It often shows, for example, that you are holding more cash than is really necessary, at interest rates that are zero or even negative in many cases. In other cases it can show a higher than expected allocation to equities, as a result of increasing stock prices.

You may also need to decide whether to increase, reduce, or maintain the size of your P2P investment portfolio. But what is the outlook for P2P? What about Covid-19? Below we give our thoughts on the impact of Covid-19 on P2P investing, the outlook for P2P, and why, in our view, now is a great time to build a larger P2P investment portfolio.

How did Covid-19 impact P2P?

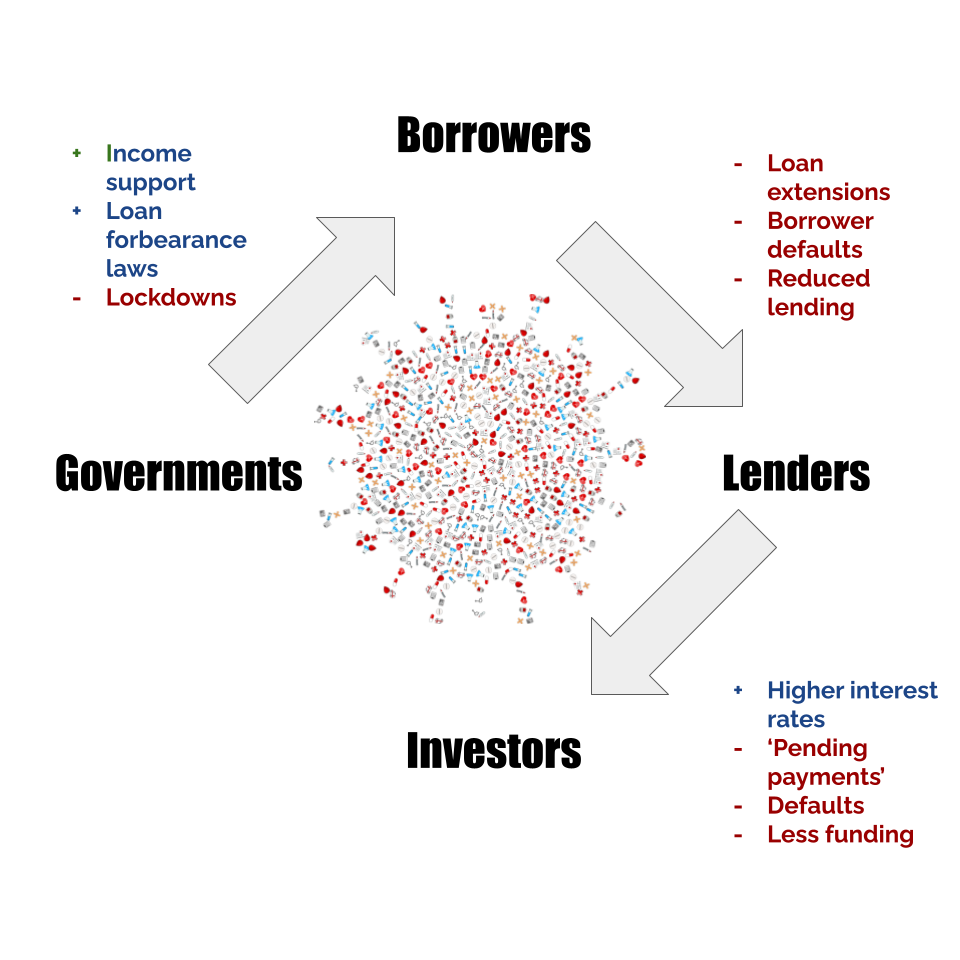

Everyone knows how much impact Covid-19 has had on our lives and economies. But how did all this disruption impact P2P investors, and the lending companies and borrowers that they were connected to? The illustration opposite shows the impact of Covid-19 on borrowers, lenders, and investors, and their responses to it by national governments. Most countries introduced some form of lockdown laws. This led to:

- Many companies losing revenues. In response they often cut the numbers of employees and needed to reschedule or default on their loan payments (including loans funded on P2P platforms

- Disruption to the property sector. Some property developments were unable to be completed. And some markets that relied on foreign investors (particularly in places such as the Baltics and Spain) suffered as travel restrictions prevented sales from taking place

- Unemployment and reduced wages – Many people saw their income reduce significantly or totally as a result of unemployment, reduces hours, and loss of self employment revenues

- Government laws brought in to protect borrowers. This often was in the form of allowing borrowers more time to make repayments. In some cases, there were also restrictions placed on the amount of interest that could be charged, and the ability of lenders to seek recovery of collateral assets.

Credit quality deteriorated in the first half of 2020

Many investors reduced their P2P portfolios during 2020

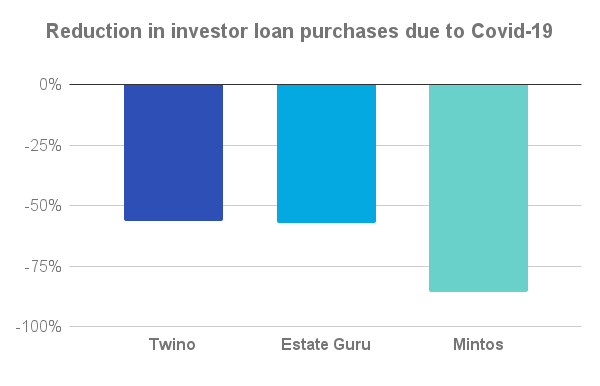

The emergence of Covid-19 led to investors dumping investments and reducing risk across the board. In America, the S&P 500 fell over 30% during February and March 2020, with similar crashes across global stock markets. P2P investors were also very quick to reduce the amount of cash they invested into P2P loans. The chart opposite shows the reductions in loan purchases on European P2P sites Twino, EstateGuru and Mintos following the outbreak of Covid-19. All three sites saw a reduction of loan volumes purchased by investors of over 50% during the period between January and April 2020. Mintos suffered a particularly large impact, with volumes down by an incredible 86%.

However, since then we have seen a return to growth in volumes across almost all P2P sites, although Mintos monthly loan purchase volumes remain significantly below their peak.

Why is the outlook good for P2P right now?

Weak lenders died

The weakest lenders (and borrowers) have now been weeded out. Covid-19 has been a huge ‘stress test’ for lenders across the world. Fewer borrowers were able to repay their loans. Funding became more expensive and difficult to obtain. There were huge operational challenges. Many lenders were unable to survive. Those that have survived are now stronger for the experience, and emerge with an enhanced reputation

Economies are rebounding

As economies emerge from lockdown restrictions, there has been strong GDP growth in most countries. The OECD forecasts global growth of 5.8% for 2021. The UK, an important market for P2P, is expected to grow by even more - 7.2%. Strong economic growth is expected to continue into 2022, with growth forecast to be 4.4% by the OECD. When economies are growing this quickly, it usually translates into lower levels of unemployment, and less bad debts. This makes P2P investments less risky.

Loans are better quality

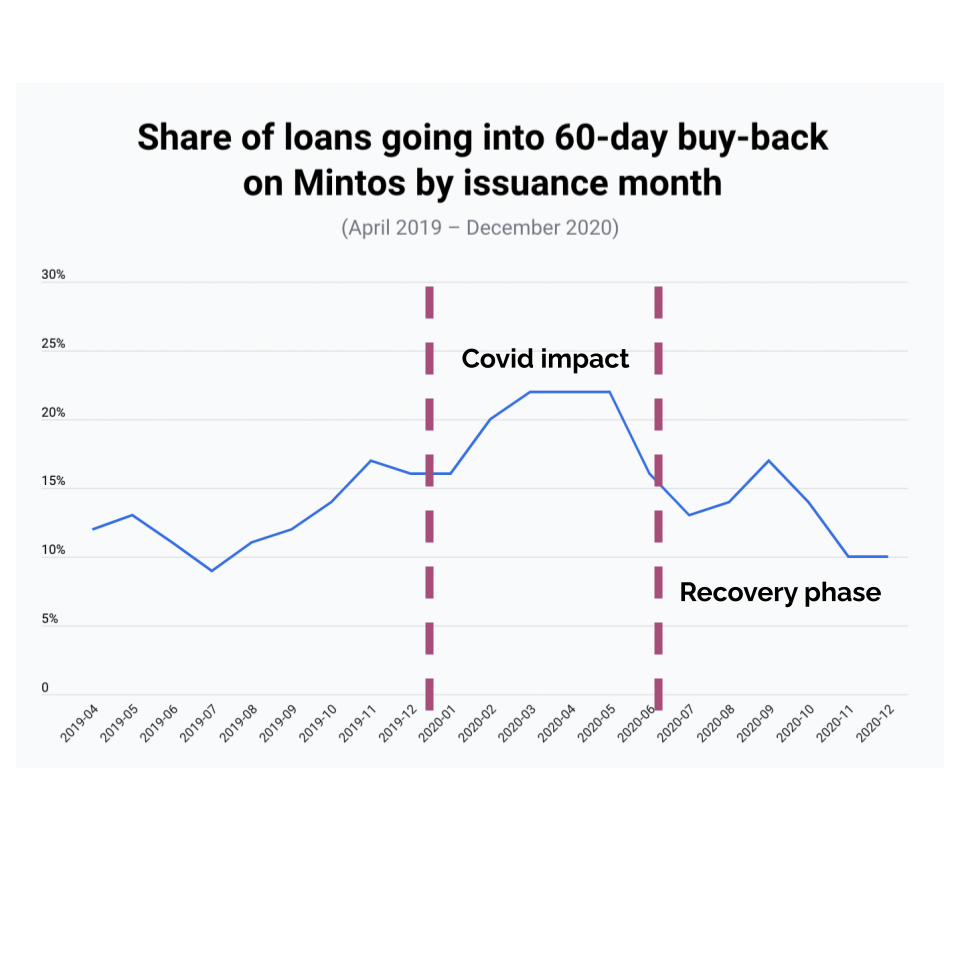

Most lenders cut their lending in 2020. This was partly caused by lower demand for credit, but it was also because lenders were concerned about credit risk. Consequently, the loans that were made during the second half of 2020 and first half of 2021 were to borrowers with better than normal credit profiles. The result of this is clear - fewer loans made during this period have defaulted, and most lenders will continue to benefit from these strong lending cohorts over the next 12 months.

Fewer lockdowns and restrictions

As Covid-19 vaccination rates have increased, we have seen a gradual removal of various rules and restrictions introduced since Q1 2020. In particular, we have seen most loan ‘forebearance’ schemes end, where borrowers were given the option to extend loans and reduce the level of payments made. We are also seeing more businesses able to reopen, and self employed people able to resume their activities. While it is unclear what the impact of winter will be on Covid-19 infection levels, most governments will be aiming to avoid new lockdowns, particularly because it is not economically sustainable to continue funding the huge amounts spent to support people and businesses during 2020 and 2021.

Rates are currently strong relative to risk

We expect that in the long term the interest rates paid to P2P investors will fall. Why? As some of the more established P2P lenders develop longer track records they will find it easier to obtain cheaper sources of funding from elsewhere. We can already see this happening to some extent on sites such as Moncera and Peerberry who source funding for some of the higher quality lending companies. We also expect to see higher demand for P2P loans from investors over the next 12 months. However, we don't think rates will fall too far below current levels, which in our view are attractive relative to the risk.

Most lenders are profitable again

We have been keeping a close eye on the financial results released by P2P lenders, as part of our lender ratings. We have seen a very substantial turnaround in performance since June 2020, leading to score upgrades for many lenders. Lenders are benefiting from lower provisions for bad debts, and many have also used the crisis as an opportunity to find ways to restructure their operations and cut costs. The outlook for profits remains strong

Less risk than equities

World stock markets have almost doubled since the lows of March 2020. That’s an incredible run, that most of our readers will have benefited from. However, there has recently been some volatility, and there is of course some downside risks after such a strong run. While P2P investing does not offer the upside returns of equities, it also has much less downside risk too. Making a return of 8-10% over the next year in P2P may end up looking very good for some investors.

Where to invest

Thinking of adding to your P2P investment portfolio? Then check out our bonus offers page, that contains a list of all the promotions currently being run by P2P sites that would like you to become a new investor.

Our comparison tables list all the reputable sites that are available to investors, by category. You can also find our current Top-10 list of P2P sites.