What is peer to peer investing?

Peer to peer (often shortened to ‘P2P’) investing is simply a way of connecting investors with borrowers. Traditionally this role has been performed by banks. P2P technology means that banks can be cut out of the picture, which can result in lower interest charges for borrowers, and higher returns for investors than bank deposits. P2P allows investors to receive most (and in many cases all) of the interest paid by borrowers.

How does peer to peer investing work?

Investors

Platform

Lenders

Borrowers

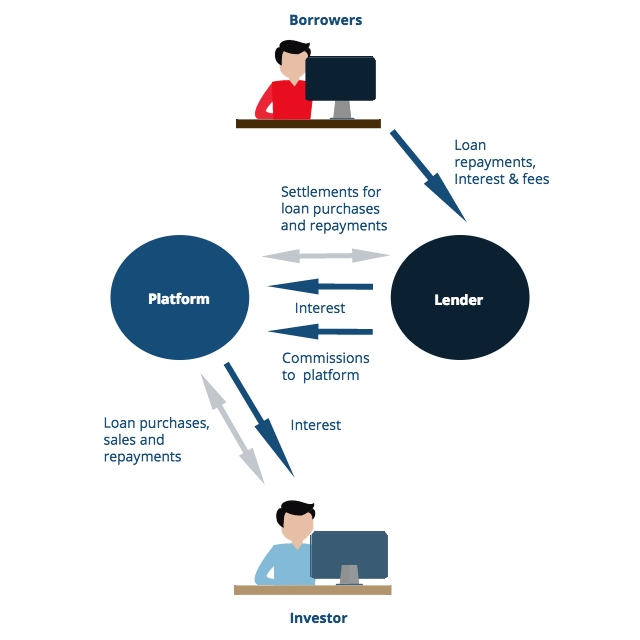

Investors provide the cash! They can choose from a huge number of ‘platforms’ to open accounts with. Once they have established their accounts, they purchase loans that are listed on the platforms. Each platform works slightly differently and has different rules. Usually, investors only purchase a small ‘fraction’ of each loan, to diversify their risk. Other investors will buy the remaining fractions, so that the borrower can get the full amount they need. Each investor then receives their share of the interest payments and principal repayments made by each borrower. If the borrower does not repay, the investor could suffer a loss (‘credit risk’).

Platforms have several important functions. They act as a marketplace to connect investors with loans that can be purchased from lenders. They are responsible for making and receiving payments between investors and lenders, and have custody of investor cash balances. The platform is also responsible for reporting on the performance of each loan and a record of the investments held by each investor. Platforms can either be independent of the lenders who have originated the loans, or they can be part of the same group.

Lenders are responsible for the relationships with borrowers, including credit checking, valuing collateral, structuring loans, executing legal documents and sending and receiving payments. They are also responsible for recovering any overdue payments, which may include debt collection activities and foreclosing on collateral. Lenders will usually receive (and keep) the arrangement fees paid by borrowers. Some lenders give all of the interest to the investors, some take a cut of the interest that the borrower pays.

Borrowers can either be individuals or businesses. The businesses that borrow using P2P lenders are often small to mid sized businesses or real estate developers. Investors often rely on the credit scoring performed by the lender, and the details of any collateral provided (if any) before deciding to invest. The amount of information provided about corporate borrowers tends to be very good. Less information is provided about individual borrowers because of data protection rules.

What is a secondary market and how do they work?

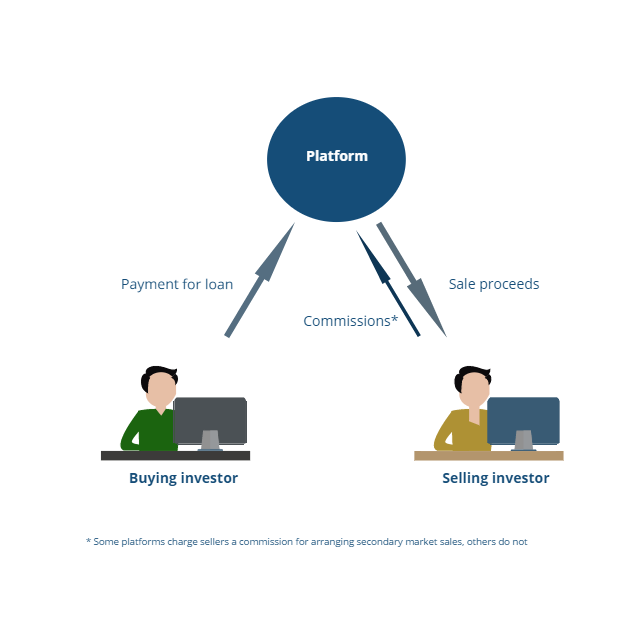

Most platforms operate ‘secondary markets’, that allow investors to trade loans between each other. Secondary markets are extremely valuable tools for P2P investors, and some won’t purchase loans unless a secondary market exists. Secondary markets allow allows investors to sell their investments before a loan matures. They might want to do this for several reasons. Usually, this will be because cash is needed earlier than expected, or there is an opportunity to sell at a profit. Secondary markets can also be useful to both buyers and sellers to diversify their portfolios. The advantage of buying loans on the secondary market is that there is usually good information available about the payment history of the borrower.

Join our quarterly newsletter

Our quarterly newsletter has details of the latest sign up bonuses, news, tips and more. We will never pass on your details to any third parties (unless you ask us to).

Our legal page contains disclosures and the full terms and conditions of the use of the ExploreP2P site.