British P2P firms lost £67 million in the last 12 months

Over the last month, many British P2P firms have disclosed their latest financial results. This gives us an opportunity to take a fresh look at the overall industry performance, and seek some clues on how the industry may develop in the future. We have reviewed the performance of the most important 30 British platforms operating currently, which captures most of the P2P sector. The platforms we have excluded from our analysis are just too small, or too new to justify inclusion at this stage.

Only 2 (Lendy and Assetz Capital) out of these 30 firms are making profits currently. 3 are operating around break even level. 25 out of the 30 P2P firms generated losses in the last 12 months reported. Overall, the British P2P industry generated a combined loss of £67 million in the last 12 months reported by each platform.

The Big 5 British platforms have been struggling to translate their size into profits

The table below summarises the results of the largest 5 British P2P firms in their disclosures. While our table below shows that all 5 made losses, we note that Assetz Capital have stated that they made a profit of more than £1 million in the year to March 2017, and further profits in the period to September 2017. However, their last filing of their financial statements was for the year to March 2016.

So what’s going on? Why are many of the largest and most sophisticated platforms failing to generate earnings? Most of the platforms have blamed the need to ‘invest’ in staffing, marketing and technology. As these 3 items make up almost the entire costs of operating a platform, it doesn’t really offer many clues. It is surprising for example, that Funding Circle’s expenses grew by £30 million during 2016, while achieving revenue growth of only £20 million.

However, from a P2P investor perspective, what matters is whether each firm will be able to continue operating until they reach profitability. We think that the risk that any of these platforms will cease to operate in the future due to a lack of funding is low.

| Platform | Date of last accounts | Revenue | Net Assets | Profit |

|---|---|---|---|---|

| £mm | £mm | £mm | ||

| Lendinvest | 31/3/2017 | 22.1 | 8.4 | -1 |

| Assetz Capital | 31/3/2016 | Not disclosed | 0.7 | -2.9 |

| Ratesetter | 31/3/2016 | 18.5 | 24 | -4 |

| Zopa | 31/12/2016 | 33.2 | 11.7 | -5.8 |

| Funding Circle | 31/12/2016 | 50.9 | 104 | -36 |

Most firms have strong shareholder backing and high valuations attached to them. If more capital is needed to cover further losses, we think they would be able to raise it. We think the bigger risk for investors is that these firms will obtain banking licences and/or cheaper sources of funding, and tell P2P investors that their capital is no longer wanted. We have seen this happen to some extent with Zopa already, and others may follow.

Most of the mid-sized firms have thin capital bases and are yet to reach break-even

Lendy is currently the most profitable P2P firm across the whole industry, with profits of £2.7 million in 2016. Many of the mid-sized firms lost money in their last financial period, but most have shown strong lending volume growth during 2017. As P2P firms require a minimum scale to reach profits, we would expect many of these firms to reach break-even and profits relatively quickly. In fact, Funding Secure recorded a small profit in the year to June 2016, and Bridgecrowd broke even in their most recent financials.

The outlier amongst the mid-sized firms is Market Invoice. Its losses grew from £3 million to £6 million during 2016, with only a small increase in revenues. Market Invoice has been achieving low returns for its investors since 2015 and it will be interesting to see whether it retains support from investors.

| Platform | Date of last accounts | Revenue | Net Assets | Profit |

|---|---|---|---|---|

| £mm | £mm | £mm | ||

| Funding Secure | 30/6/2016 | 2.1 | 0.5 | 0.4 |

| Lending Works | 31/12/2016 | Not disclosed | 0.5 | -1.7 |

| Thincats | 31/12/2016 | 0.9 | 3.5 | -0.9 |

| Folk 2 Folk | 31/1/2017 | Not disclosed | 0.6 | -1.1 |

| Growth Street | 31/12/2016 | Not disclosed | -0.8 | -0.5 |

| Bridgecrowd | 31/3/2016 | Not disclosed | 0.1 | 0.0 |

| Lendy | 31/12/2016 | Not disclosed | 3.1 | 2.7 |

| MarketInvoice | 31/12/2016 | 4.4 | 6 | -6 |

| Landbay | 31/12/2016 | Not disclosed | 1 | -1.7 |

| Collateral UK | 30/11/2016 | Not disclosed | -0.3 | -0.2 |

| Octopus choice | 30/4/2017 | 2.1 | 2.9 | -1.8 |

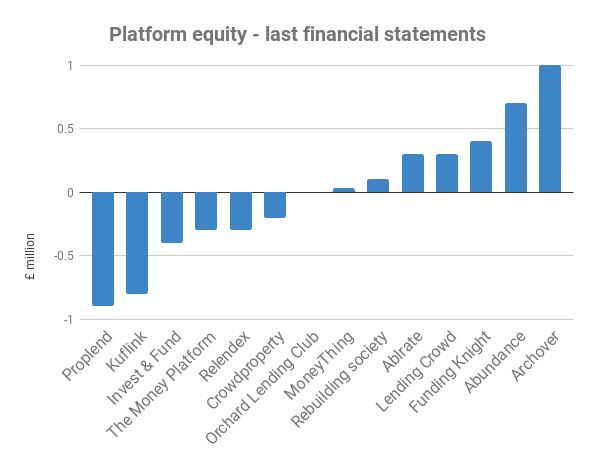

Another observation is that many of the mid-sized firms are very thinly capitalised. Some even reported a negative equity position. While many have been successful recently in raising extra capital to fund losses, the total investments made into these firms has been very modest. We think it is therefore very important to keep an eye on the growth rates of each platform. If a platform is losing money, and its volumes begin to flatten out, this creates a risk that shareholders will decide not to keep supporting the business.

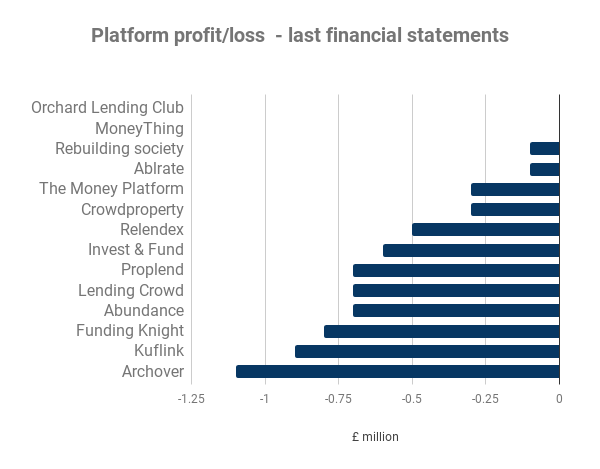

None of the smaller platforms are profitable

12 of the 14 smaller British P2P platforms generated losses, while 2 broke even. Many of the smaller platforms also have weak balance sheets, with minimal or negative levels of equity. The losses are not surprising to us – it takes time to increase lending volumes to a level that generates sufficient revenues to cover the cost of running a platform. However it has been surprising to us that the FCA has been willing to authorise some firms that have received only very modest levels of investment from their shareholders.

We don’t expect all of these platforms to still be operating in 2-3 years time. Some platforms, such as Kuflink, only launched recently and have been showing good progress during 2017. However others appear to have stalled or even gone backwards this year. We recommend keeping an eye on the volume data provided by Altfi for each platform. Let’s be clear – if a platform is loss making, has little or negative equity, and is also struggling with lending volumes, the prospects of survival are not good.

What's the outlook?

We expect a lot of change over the next 2-3 years. New platforms will keep launching, but there will be fewer launches than in recent years. We expect that some of the platforms we cover may decide to close down. These will be the platforms that lack substantial shareholder investments, are losing money, and have been struggling to create or build momentum.

Industry profits should improve considerably during 2017. P2P lending volumes have been growing at 35%, and this should be translated into higher revenues for most platforms.

Many platforms will diversify their funding sources, so they don’t need to rely entirely on ‘retail’ P2P investors. They will obtain funding from credit funds, institutions and investment banks. Funding Circle already does this, and as each platform grows and builds up their lending track record, these sources of capital will become available. This creates opportunities for platforms to increase their profits, although it may come at the expense of reducing opportunities for P2P investors.

Finally, we expect several platforms to expand into other countries in the future. We have seen some early signs of this, with Ratesetter entering Australia, and Funding Circle launching in the USA. We expect more platforms to leverage their technology and experience to launch in more countries in the future.

In the context of the overall lending market in the UK, P2P is still very small. We see opportunities for P2P volumes to keep growing strongly for several years to come.