Our pick of the best P2P loans currently available

We list below what we think are some of the best P2P loans currently available in the UK and Europe. These loans may sell out very quickly. Even if they do, it is likely that similar opportunities are available on each platform.

Our goal is to help highlight the types of opportunities that are available on various platforms, and which types of loans offer the best balance of risk and reward.

Description

Why we like it

Link

Interest rate: 10%

LTV: 56%

Term: 60 months

1st lien Mortgage (Fully amortising)

Lithuania

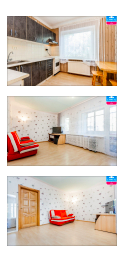

Interest rates have been falling on the Mintos platform recently. One of their largest lenders, Mogo recently repurchased a large amount of loans, which left many investors holding excess cash on the site. We think this is a good opportunity for investors to trial some of the other European P2P sites that are offering better risk adjusted returns right now. However it is still possible to find some decent loans if you look carefully. The loan we are highlighting here is a mortgage loan from Hipocredit. Hipocredit have shown us that they have been quite effective at repossessing and selling properties recently when borrowers have defaulted. We like this loan in particular because the collateral is a high quality apartment in the Vilnius, the capital of Lithuania. The borrower has made the first 5 monthly payments on time, and the loan is fully amortising over just 5 years, which will result in the LTV falling quickly over the life of the loan. We think that a 10% return represents good value compared to other loans currently available on the Mintos primary market.

Interest rate: 9%

LTV: 75%

Term: 18 months

1st lien Mortgage

Estonia

We have been fans of Estateguru for some time now, but we continue to prefer their bridge loans to the development loans they offer. We think the bridge loans, such as this one, are significantly lower risk. The collateral for this mortgage loan is a well appointed flat based in the capital of Estonia, Tallinn. This makes the property quite easy to value and also easy to sell if things go wrong. The property is currently rented out to holiday visitors on booking.com and a visit to the property page on that site shows that rental prices for this property are quite high and the feeback is very positive on average. This means that the borrower should generate more than sufficient income to cover the interest on this loan. While the LTV is slightly higher than we see normally on Estateguru, we would much prefer to have a higher LTV on a quality asset like this, than a lower LTV on some of the collaterals of their other loans, such as land etc.

Interest rate: 10.2%

LTV: 53.7%

Term: 24 months

2nd lien mortgage

England

We continue to think that Bridgecrowd loans offer some of the best risk adjusted returns anywhere in P2P at the moment. They have a minimum investment of £5,000 for each loan, but for investors who are lucky enough to have larger amounts to invest, Bridgecrowd is currently the place to be in our view. That being said, it’s still pays to be selective about which loans to invest in. We favour loans secured against collaterals that have medium to lower values, as the market for high value properties in the UK is currently very slow. The collateral of this loan is based in Harrow, North London. We like the low LTV of 53.7% and also that the borrowers own multiple properties, which in our view reduces the likelihood of a loss from any default.

Interest rate: 6.6%

Stated LTV: 63%

Term: 6 months

1st lien mortgage

England

This loan from Kuflink has some similarities to the Bridgecrowd loan above. The collateral is also located in London, with a low to mid value. The borrower also has another investment property, and this loan is a simple bridge facility until longer term financing can be arranged. The stated LTV is 63%, but as Kuflink takes a 20% ‘first loss’ position in each loan, the effective LTV is only 50%. Yes, the interest rate is ‘only’ 6.6%, but for a loan with this low risk profile and simplicity, we think that’s not bad. Kuflink are also currently offering quite a generous £100 bonus for new investors (see our bonuses page for details)

And here is what we DON'T love right now....

Interest rate: 6%

LTV: 88%

Term: 36 months

Latvia

The last time we ran our ‘loans we love’ post we highlighted the attractiveness of buying Mogo loans on the Mintos platform. Loans could be purchased at a 12% interest rate, and on top of this investors could receive up to 5% cashback due to a promotion. This ended up being a fantastic ‘trade’ for investors as Mogo subsequently bought back many of these loans shortly thereafter, which meant investors kept the cash-back and also received a 12% yield. We know many investors who did this in a big way and earned great returns as a result. However unfortunately Mogo loans are now our designated ‘loans we DON’T love’ right now. Firstly we think the 6% returns on offer are not attractive relative to many other P2P opportunities. We also expect that Mogo will in the coming months come back to the Mintos marketplace and they are likely to be willing to pay more than the 6% being offered. Rates may never reach the 12-13% levels of the past, but it’s hard to see them getting much investor take-up unless it is at least in the 8-9% region. For now, these loans offer very poor returns compared to other opportunities that exist.

If you are interested in any of the loans above, please make sure to read all the information provided by each investment site and make sure that they are suitable for you. While we aim to highlight interesting opportunities, you must perform your own assessment of the risks and decide whether these, or similar loans offered each site are suitable for your investment objectives.

12M Mogo loans are at 9,5% now, so i guess that interest raize came earlier than expected!

Keep up the good work!

In your lender ratings Hipocredit achieved a poor score. Can you expect that a loan issued by them will continue to pay normaly (and the collateral be sold if necessary) in case Hipocredit becomes bankrupt?

Hi Osmium. It’s a great question. We understand that Hipocredit has been significantly reducing its average cost of funding so we expect their score to improve a lot in the next 12 months, as it gets the benefit of this and also growth in volumes. We think that the impact on lenders of an insolvency is likely much less than for unsecured lenders, as the mortgage security will continue to be in place and it is relatively easy to switch the servicing of secured loans. Lenders are also not relying in Hipocredit to satisfy any buyback guarantees.